W-2 Physician? Paying a Ton in Taxes? Here’s How to Cut Your Tax Bill!

3 Powerful Strategies to Reduce Your Taxes!

I Was wrong to think W-2 Physicians had no tax saving options.

When I was a newbie tax strategist, I believed that if you had a W-2 job without a side gig, your tax-saving options were limited to maxing out your 401(k) and doing a backdoor Roth for future tax benefits.

Turns out, I was completely wrong.

As I dove deeper into creative tax strategies, I realized that high-earning W-2 physicians actually have powerful ways to reduce their tax burden—if they know where to look.

In this article, I’ll break down three key strategies W-2 physicians can use to lower their tax bill.

Why W-2 Only Physicians Have Limited Tax Strategy Options

First, let’s discuss why W-2 physicians typically have limited options for reducing their tax bills.

To understand these limitations, it’s essential to review how individual taxation works.

Quick Taxation Summary

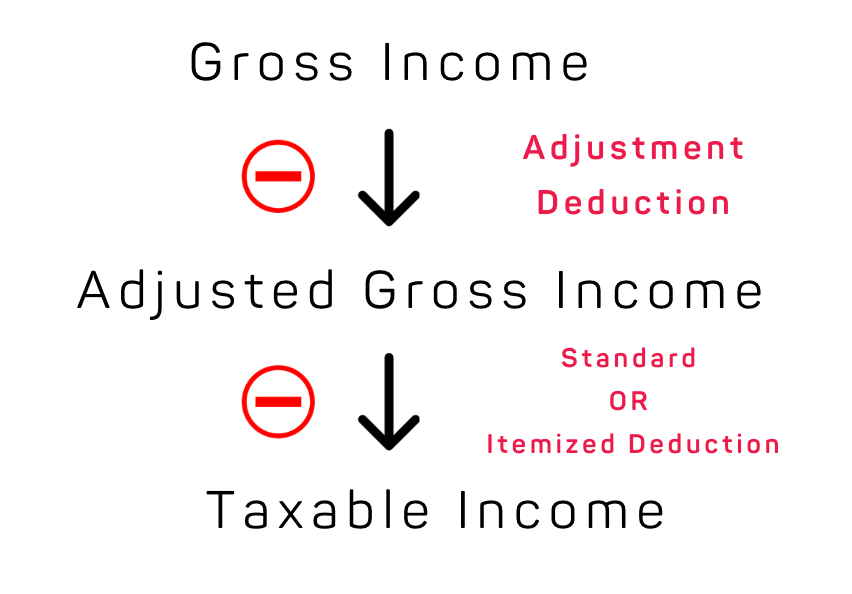

When you receive W-2 income, it becomes your gross income. From there, your goal is to reduce your gross income through two types of deductions: adjustment deductions and standard vs. itemized deductions, in order to reach the lowest taxable income possible.

Adjustment Deductions (Also Called Above-the-Line Deductions)

These deductions reduce gross income, resulting in Adjusted Gross Income (AGI).

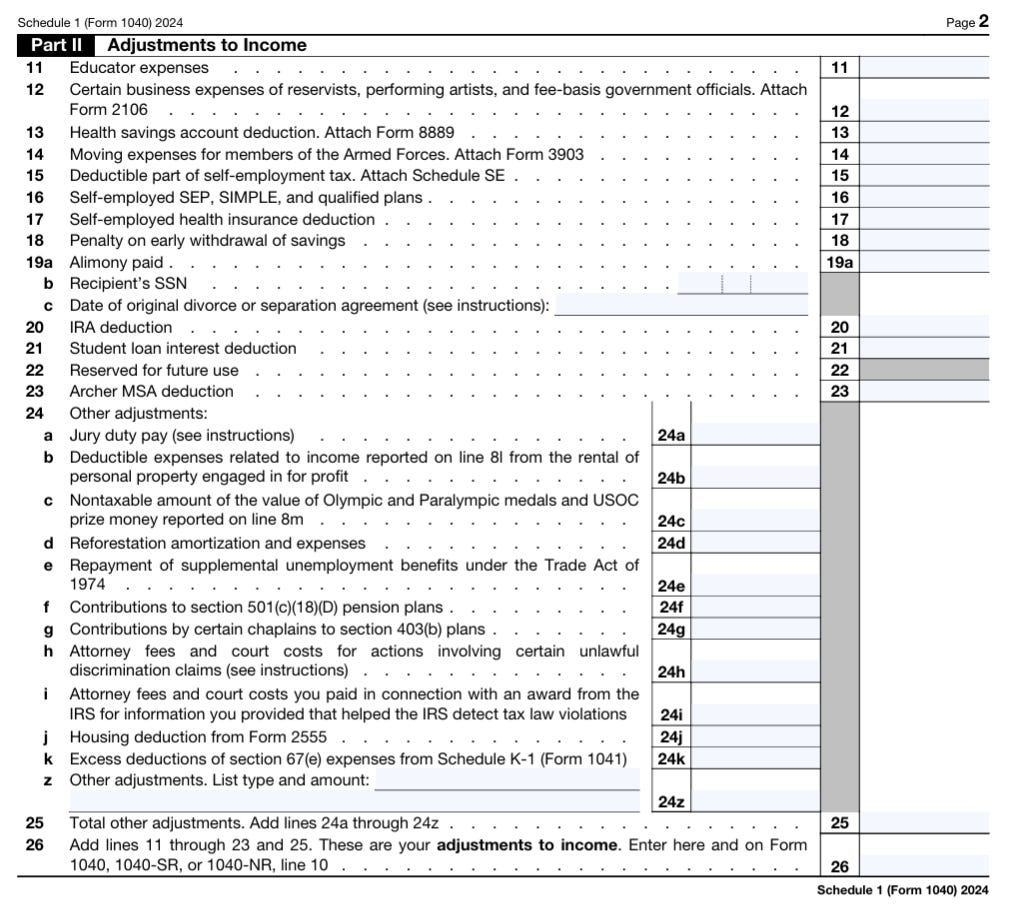

The list of adjustment deductions is found in Part 2 of Schedule 1. For high-income W-2 physicians, most adjustment deductions do not apply, meaning they have little to no access to these tax-saving opportunities.

Standard vs. Itemized Deductions

Once AGI is calculated, you can apply either the standard deduction or itemized deductions.

If you own a home with a mortgage, you are more likely to itemize deductions. For a deeper dive into itemized deductions, check out this article: Tax Waste: Know It to Eliminate or Reduce.

3. Federal Income Tax Calculation

After determining taxable income, you apply the federal tax brackets to calculate your tax liability.

The lower your taxable income, the lower your tax bill—duh, right? 😆

What Can High-Income W-2 Physicians Do If No Adjustment Deductions Are Available to Them?

You can create them.

How?

Just like shopping at Nordstrom, you can actually “buy” adjustment deductions—by investing in a business that generates business-related expenses and deductions.

This is what wealthy people do to lower their taxes.

Who Can Benefit?

If you’re in the 35% or 37% tax bracket (earning $500K+ annually) and live in a high-tax state like California, this strategy can work well for you.

How It Works:

You buy an interest in a business structured as a partnership and receive business deductions to lower your taxable income since business deductions acts as adjustment deductions.

Example:

You invest $200K in an oil and gas partnership.

You receive $160K in business deductions in Year 1 via intangible drilling cost deductions and depreciation.

This lowers your AGI and taxable income by $160k in Year 1.

Limitations to Consider

There’s no free lunch—this strategy comes with important rules and limitations:

Material Participation – You must meet the material participation requirement to use business deductions against W-2 income. It requires active involvement in the business (e.g., spending 500+ hours annually on day-to-day business operations). For oil and gas partnerships, you can meet this by assuming unlimited liability in Year 1 for the business operations (known as a general partner election).

Business Loss Limitations – You can only deduct up to $626K in business losses against W-2 income, if you file jointly with your spouse ($313k for single). This limit is set to expire at the end of 2025.

At-Risk Rules – Your deductible losses cannot exceed the amount you have at risk (i.e., the amount you can actually lose), which includes your cash investment + any debt you assume.

Two Additional Ways to Lower Your Tax Bill

1. Increasing Itemized Deductions

By strategically using charitable contributions, you can increase your itemized deductions and reduce taxable income.

For example, if you donate $50K to a leveraged medical donation program, you could potentially increase your itemized deduction by $250K, lowering your taxable income by that amount.

Sounds too good to be true? That’s because it comes with a high IRS audit risk—remember, there’s no free lunch. I’ll cover this strategy in more detail in a separate article.

2. Leveraging Tax Credits

You can invest in a business that qualifies for investment tax credits (ITCs), which reduce your tax liability dollar-for-dollar.

For example, if you invest $100K in an renewable energy business, you could potentially receive $114K in ITCs, allowing you to recoup your investment almost immediately.

This strategy has many nuances that need careful planning, so I’ll break it down in detail in a future article.

Case Study: W-2 Physician Couple Making $1.5M in California

Scenario 1: No Tax Strategies Used

Income: $750K salary (each) → Total = $1.5M

Taxes Owed (estimated):

Federal Tax: $470K

CA State Tax: $156K

FICA Taxes: $52K

Total Tax Bill: $678K (45% of income)

Scenario 2: Using Strategic Tax Planning

Strategy #1: Invest $200K in oil/gas → $160K AGI reduction

Strategy #2: Invest $50K in leveraged medical donation program → $250K additional itemized deduction

Strategy #3: Invest $200K in renewable energy business → $228K tax credit

New Taxable Income: $1.09M (down from $1.5M)

New Taxes Owed (estimated):

Federal Tax: $329K (↓$141K savings)

CA State Tax: $136K (↓$20K savings)

FICA Taxes: $52K (unchanged)

Tax Credits Applied: $228K reduction

Total Tax Bill: $289K (↓$389K in reduction)

Effective Tax Rate Drops from 46% → 19% in Year 1

Important Considerations

The above illustrates a possible Year 1 tax outcome but does not guarantee results.

Like any investment, oil and gas investments carry financial risks—you can lose money.

Renewable energy business investments may generate additional taxable income in Year 2, which could increase the couple’s tax liability and offset much of the Year 1 tax benefits.

Leveraged medical donation programs carry an extremely high risk of IRS audit (nearing 100%). This strategy is not for the faint of heart and requires significant risk tolerance.

Final Thoughts

High-income W-2 physicians do have options to lower their tax bills—including “buying” adjustment deductions, investing in charitable programs (very risky), and investing in businesses that generate tax credits.

While the examples above are for illustration purposes only and don’t cover all the nuances, strategic tax planning for high-income W-2 physicians is very real and widely used by wealthy individuals.

Depending on your risk tolerance and financial goals, there are many legal, IRS-compliant strategies that can significantly reduce your tax liability—if executed correctly.

If you’re interested in learning more about these strategies, contact me.

Disclaimer 1: click here

Disclaimer 2: As a licensed tax professional (Enrolled Agent), I am not permitted to recommend specific financial products or receive commissions for referrals.