Thinking About Starting a Group Practice with Other Docs?

Recommended Entity Structure & Tax Implications in a Nutshell

“Kenny Kim, I’m starting a group practice in San Francisco, CA, with two of my plastic surgeon colleagues. We each specialize in different areas of plastic surgery, and I anticipate earning significantly more than the other two surgeons. How should we structure our entity to optimize tax savings, ensure liability protection, and create an equitable practice?”

I’m sure many physicians have a similar question when forming a group practice.

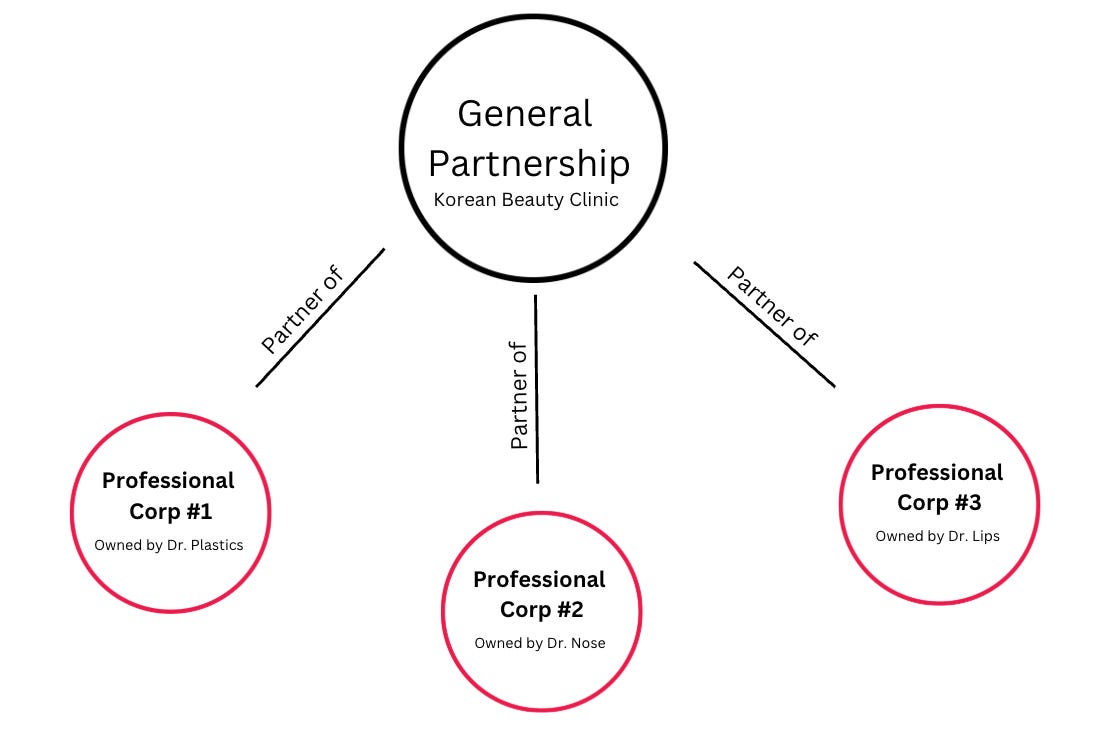

In this article, I’ll review a recommended entity structure that best meets the needs of Dr. Plastics and his group practice, Korean Beauty Clinic.

The Corporate Practice of Medicine (CPOM) Doctrine and Entity Selection

In California, the Corporate Practice of Medicine (CPOM) Doctrine prohibits non-physicians (e.g., nurses) and non-professional corporations (e.g., LLCs) from owning or controlling a medical practice. This means that Dr. Plastics and his partners must operate through a professional corporation (PC) if they choose to form an entity.

Since each physician will generate different levels of revenue while sharing administrative and operational expenses, the entity structure should allow each physician to take home what they earn. It would be unfair for a rainmaker like Dr. Plastics to split profits evenly among all three surgeons.

Why a Partnership May Works Best as the Parent Entity for Korean Beauty Clinic

Since the profits from the group practice will be divided unevenly based on each physician’s performance, a partnership is the ideal structure for Korean Beauty Clinic.

Why?

A partnership provides the most flexibility when it comes to profit allocation. Unlike an S corporation, which requires profits to be distributed strictly based on ownership percentage, a partnership allows for special allocations that reflect each physician’s actual revenue contribution.

For example, if the parent entity were an S corporation and Dr. Plastics owned only 1/3 of the S corporation, he would be required to take exactly 1/3 of the net profits—even if he generated significantly more revenue than his partners. That would be unfair and not aligned with economic reality.

Additionally, since medical care must be provided through a PC in California, the partnership should consist of three partners, each being a professional corporation (PC) owned by a surgeon.

This structure:

Complies with CPOM regulations – Each PC provides medical services to its patients, while the partnership (Korean Beauty Clinic) handles non-medical operations, such as billing, collections, clinic staff management, equipment leasing, and payroll services.

Ensures fair physician compensation – Instead of rigid ownership-based profit sharing, each physician is compensated based on their individual revenue contribution, making it a more equitable structure.

Addressing Liability Concerns Related to a General Partnership as the Parent Entity

A general partnership typically exposes partners to unlimited personal liability. If a patient falls and suffers a subdural hematoma leading to permanent brain damage, each general partner could be held liable for the lawsuit judgment, potentially putting their personal assets at risk.

However, in this setup, each general partner is a professional corporation (PC) rather than an individual, which helps limit personal liability. Only the PC’s assets are at risk in a lawsuit, not the physician’s personal assets.

Critical Tax Considerations: Partnership Tax Rules Are Complex

Partnership taxation is one of the most intricate areas of tax law.

From a tax perspective, the way a partnership distributes net profits to each PC must strictly follow partnership tax rules. However, due to the complexity of these rules, they are often not strictly followed in practice. While IRS scrutiny in this area is relatively low, failing to properly structure income allocation can still pose significant tax risks.

To minimize these risks, the partnership agreement must be carefully drafted by a professional with expertise in partnership taxation.

In Dr. Plastics’ case, the agreement should clearly define how income is allocated among partners—for example, based on each physician’s revenue contribution. The allocation must reflect economic reality (e.g., a partner who generates more revenue should receive a larger share of the profits).

This is generally determined under the partner’s interest in the partnership (PIP) rule or must fall within the substantial economic effect safe harbor, both of which are highly technical areas of partnership tax law.

Bottom Line: Hire a Tax Professional Specializing in Partnership Taxation

Alternative Entity Options

#1: Each PC Operates Independently with an MSO (Management Services Organization)

Structure: Each physician maintains a separate professional corporation (PC) but shares administrative costs through an MSO.

Pros: Provides flexibility and separates financial risk between individual practices.

Downside: They cannot market themselves as a group practice legally, limiting branding potential.

#2: S Corporation as Parent Entity

Structure: A single S corporation is jointly owned by all three PCs.

Pros: Simplifies operations under one legal entity while preserving corporate liability protection.

Downside: Profit must be distributed strictly based on ownership percentage, rather than each physician’s actual revenue contribution.

Example: If Dr. Plastics’ PC owns 33% of the S corporation, he can only receive 33% of profits—even if he generates most of the revenue.

Potential Workarounds: There are indirect ways to compensate Dr. Plastics more (e.g., higher salary or bonuses), but these may not be ideal or as flexible as a partnership structure.

Final Thoughts

For a group practice where one physician generates significantly more revenue than the others—like Korean Beauty Clinic—a general partnership as the parent entity is the most effective structure due to its flexible profit-sharing capabilities.

Additionally, using professional corporations (PCs) as partners helps protect each physician’s personal assets, even though a general partnership typically exposes partners to unlimited liability.

However, given the complexity of partnership tax rules, proper structuring is essential to maintain IRS compliance and avoid potential tax pitfalls.

If you are forming a group practice, get professional guidance

consult a business attorney to ensure compliance with state medical practice laws and entity requirements.

hire a tax professional with expertise in partnership taxation to ensure proper tax treatment and compliance.

Disclaimer: click here