Thinking About Buying a House for Your Mom and Renting It to Her for Free or at a Big Discount?

Here Are 3 Hidden Landmines You Must Know Before You Do It

Many of my colleagues have a heart of gold (you, Dr. Spine!) They not only care deeply for their patients but also want to support their families. I often hear them considering buying a house to rent to their mom (or another family member) as a way to provide financial help.

While this can be a rewarding experience, there are significant tax and financial consequences to consider. If you’re planning to buy a property and rent it to your mom, it’s crucial to fully understand these implications. That’s the focus of this article.

The Common Thought Process

Many physicians assume they can buy a rental property, rent it to a family member for free or at a steep discount, and generate a large tax loss to offset their income. However, the IRS has specific rules that can limit or even disallow this tax strategy, often leading to unexpected tax consequences.

Before moving forward, be aware of three major landmines that could create significant financial and tax pitfalls.

#1: Renting to Family at More Than a 20% Discount Can Disqualify Rental Deductions

This is the most critical rule to understand before renting to a family member.

For the IRS to treat the property as a rental—allowing you to take deductions—two key conditions must be met:

The family member must use the property as their primary residence.

You must charge fair market rent.

In Estate of Bisdseil v. Commissioner, T.C. Memo 1986-219, the court ruled that a 20% discount to a family member is acceptable while still treating the property as a rental for tax purposes.

What This Means for You

If you charge at least 80% of fair market rent, and your mom lives there as her primary residence, the property should still qualify as a rental, allowing you to take deductions for depreciation, property taxes, and other expenses.

If you charge less than 80% of fair market rent—or let your mom live there for free—the IRS will likely classify the property as a personal residence, not a rental. This severely limits tax deductions, particularly depreciation.

Understanding this rule is crucial before structuring a rental arrangement with a family member!

#2: Buying a Rental in a High Cost-of-Living Area Can Create a Significant Negative Cash Flow

Purchasing a rental property in an expensive area like Pasadena, CA, can result in substantial negative cash flow, making it a long-term financial burden.

Example: Buying a 2-Bed, 2.5-Bath Townhome in Pasadena, CA

Recent Sale Price (lowest in the past 3 months): $821,000 (1,238 sq. ft.)

Market Rent: $4,000 - $5,000 per month

(Source: Redfin listing)

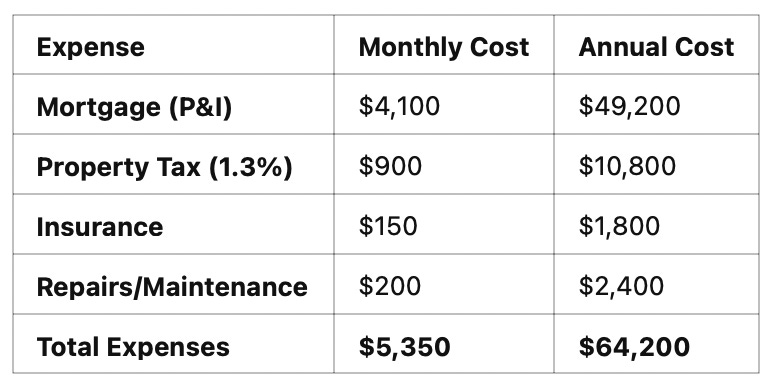

Expense Breakdown

Assumptions:

Down Payment: 25% ($205,000)

Mortgage Amount: $616,000 at 7% interest

Expenses:

Income (Charging 20% Discounted Rent to Mom):

Monthly Rent: $3,200

Annual Rent: $38,400

Net Loss:

$64,200 (expenses) – $38,400 (income) = $25,800 annual loss

If you are in a 50% tax bracket, you’d need to earn $50,000 pre-tax just to cover this annual loss. This could become an ongoing financial burden.

#3: Negative Cash Flow but Still Owing Taxes?

Even though you’re losing money out-of-pocket, you may still owe taxes on rental income.

Example: Taxable Rental Income vs. Deductions

Property Details:

Home Price: $821,000

Land Value: $321,000 (estimated; actual figure can be obtained from county tax records)

Depreciable Building Basis: $500,000 ($821,000 - $321,000)

Annual Rental Income:

Monthly Rent (20% discount applied): $3,200

Annual Rent: $38,400

Annual Deductions:

Depreciation Deduction: $18,000 ($500,000 ÷ 27.5 years)

Property Tax: $10,800

Insurance & Repairs: $2,400

Total Deductions: $31,200

Taxable Rental Income Calculation:

Annual Rent Received: $38,400

Total Deductions: ($31,200)

Net Taxable Rental Income: $7,200

Unexpected Tax Consequences:

Despite having an out-of-pocket loss of $25,800 (as shown in the previous example), you still have $7,200 of taxable rental income. If you are in a 50% tax bracket, you will owe an additional $3,600 in taxes, even though you are losing money on the property each year. This means you are essentially paying the IRS for the privilege of helping your mom—an often-overlooked downside of renting to family.

Final Thoughts

Physicians often want to help their family members financially, but before buying a house to rent to a relative, consider these three key challenges:

Rental Classification Rules: To qualify as a rental for tax purposes, the IRS requires that family members pay at least 80% of market rent and use the property as their primary residence.

High-Cost Areas Can Lead to Cash Flow Losses: Buying in an expensive area could result in tens of thousands in out-of-pocket costs annually.

Unexpected Tax Liabilities: Even if the rental is operating at a loss, you may still owe taxes on rental income due to how deductions and depreciation are calculated.

Providing housing for your family is a generous and meaningful gesture, but be sure to weigh the financial and tax implications before making your decision.

Disclaimer: click here