The $3,000 Tax Mistake I Made Before Becoming a Tax Professional

Don’t Be Like Kenny Kim in 2019!

One of the biggest tax mistakes I made before becoming a tax professional was not understanding how to report a short-term disability payout on my tax return.

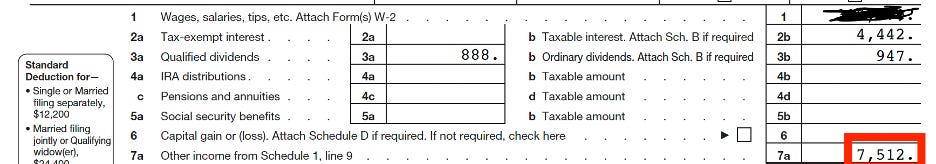

Back in 2019, I had ankle surgery and was off work for about two months. During that “vacation” time, the State of California paid me $7,512 in short-term disability benefits for missing work. (Wohoo! Free money, right?)

By then, I had already spent a decent amount of time reading tax books, so I felt confident I could handle my own taxes using TurboTax - which I had been using throughout my adult life.

The Mistake

When I received a 1099-G form from the State of California showing the $7,512 payout, I followed TurboTax’s prompts, entered the amount, reviewed everything, and submitted my tax return.

The result? I ended up owing $1,238 in federal taxes.

Normally, I would have expected a refund, but at the time, owing some money to the IRS seemed reasonable since I had received $7,512 of free income, what I thought was taxable income. So, I paid the taxes due and moved on.

Fast Forward – When I Became a Tax Professional

A few years later, after becoming a tax professional, I decided to go back and review my old tax returns, including the 2019 return I had prepared usingTurboTax.

That’s when I realized I had screwed up.

I had mistakenly reported my short-term disability benefits as taxable income—when they should have been tax-free.

What a rookie mistake!

Are Short-Term Disability Benefits Taxable?

Here’s what I didn’t know back in 2019:

My short-term disability benefits were provided through California State Disability Insurance (SDI), and SDI benefits are generally NOT taxable.

Why?

Because SDI is funded by employees through after-tax payroll deductions. Since I had contributed to the system with after-tax money, the benefits I received should have been tax-free.

That’s the general rule when it comes to disability payouts - if the insurance premiums are paid with after-tax money, the payouts are generally tax-free.

On the other hand, if the disability payout had come from an employer-paid disability insurance plan (where the employer pays the premiums pre-tax), then the payout would have been taxable income.

I didn’t know this at the time.

The Cost of My Mistake

Not understanding how disability payouts are taxed ended up costing me about $3,000 in unnecessary federal, state, and even FICA taxes.

When I finally realized my mistake and tried to amend my tax return, it was too late—the three-year statute of limitations for claiming a refund had already passed.

Ouch.

This one mistake cost me far more than what I thought I had saved by doing my own taxes with TurboTax all those years.

Final Thoughts

If your short-term disability payout comes from an insurance plan that you paid for with after-tax money, the payout is generally tax-free.

Remember that—and don’t be like Kenny Kim in 2019!

If you ever have a unique tax situation, it’s worth consulting a tax pro to avoid making costly mistakes. Trust me - paying a consultation fee may be cheaper than paying extra taxes later!

Disclaimers: click here