I Hate Tax Waste!

Growing up with very little money as an immigrant, I developed a lifelong habit of watching where every dollar went. This habit became a way of life, and it has carried over into my approach to taxes now that I am a tax professional. Just as I hated wasting any money I had, I feel the same way about wasting tax deductions.

What Is Tax Waste?

Tax waste is a term I use to describe disallowed deductions—those that taxpayers lose out on due to various limitations within the tax code. I have come to realize that it is critical for physicians (and all taxpayers) to understand these limitations so they can make informed, tax-efficient decisions to minimize their tax bills.

Today, I will focus on itemized deductions, which are full of potential tax waste.

Itemized Deductions: A Closer Look

Let’s revisit the fundamental formula I introduced in a previous article that determines your tax liability:

Gross Income – Adjustments = Adjusted Gross Income (AGI)

AGI – Deductions = Taxable Income

See: 90% of Physicians Don’t Know This Essential

When it comes to deductions, you can choose either the standard deduction and itemized deductions to reduce your taxable income, whichever gives you a greater deduction.

AGI – (Standard Deduction OR Itemized Deductions) = Taxable Income

While the standard deduction is a fixed amount based on your filing status (e.g., $30,000 for married filing jointly in 2025), itemized deductions are the sum of six different deduction categories. Each category has its own set of limitations that can lead to tax waste.

Let’s explore these limitations and discuss what can be done to eliminate or circumvent tax waste.

1. Medical and Dental Expenses

The tax waste from this category can be significant, as most physicians do not receive any tax benefit from medical and dental expenses.

Why?

Because medical and dental expenses equal to 7.5% of your AGI are non-deductible and do not contribute to your itemized deductions.

For instance, if your AGI is $350,000, the first $26,250 of your medical expenses cannot be deducted. Therefore, if you incur $20,000 in out-of-pocket medical expenses, none of it will count toward your itemized deductions, resulting in tax waste. Ouch!

Potential Solution: Health Reimbursement Arrangement

If you own a business, consider establishing a Health Reimbursement Arrangement (HRA). By hiring your spouse as an employee and providing health benefits through the HRA, you can convert non-deductible personal medical and dental expenses into deductible business expenses.

For example, in the scenario above, the $20,000 in out-of-pocket medical expenses could be deducted as a business expense, reducing your taxable business income. This allows you to receive a full tax deduction for an expense that would have otherwise been non-deductible due to the 7.5% AGI limitation.

This strategy requires careful planning and compliance with IRS regulations, so consulting with a tax professional is essential.

2. State and Local Taxes (SALT)

This is another major tax waster, especially for physicians in high state income tax states like California.

Until 2018, the state income taxes you paid, along with property taxes to your county, counted as itemized deductions.

However, the Tax Cuts and Jobs Act of 2017 (TCJA) capped the SALT deduction at $10,000. For example, if you pay $30,000 in state income taxes, only $10,000 is deductible, while the remaining $20,000 becomes tax waste.

Additionally, any other state and local taxes you pay—such as property taxes (which can easily exceed $10,000 per year) and car registration fees (which could total $1,000 per year)—are non-deductible, further contributing to tax waste.

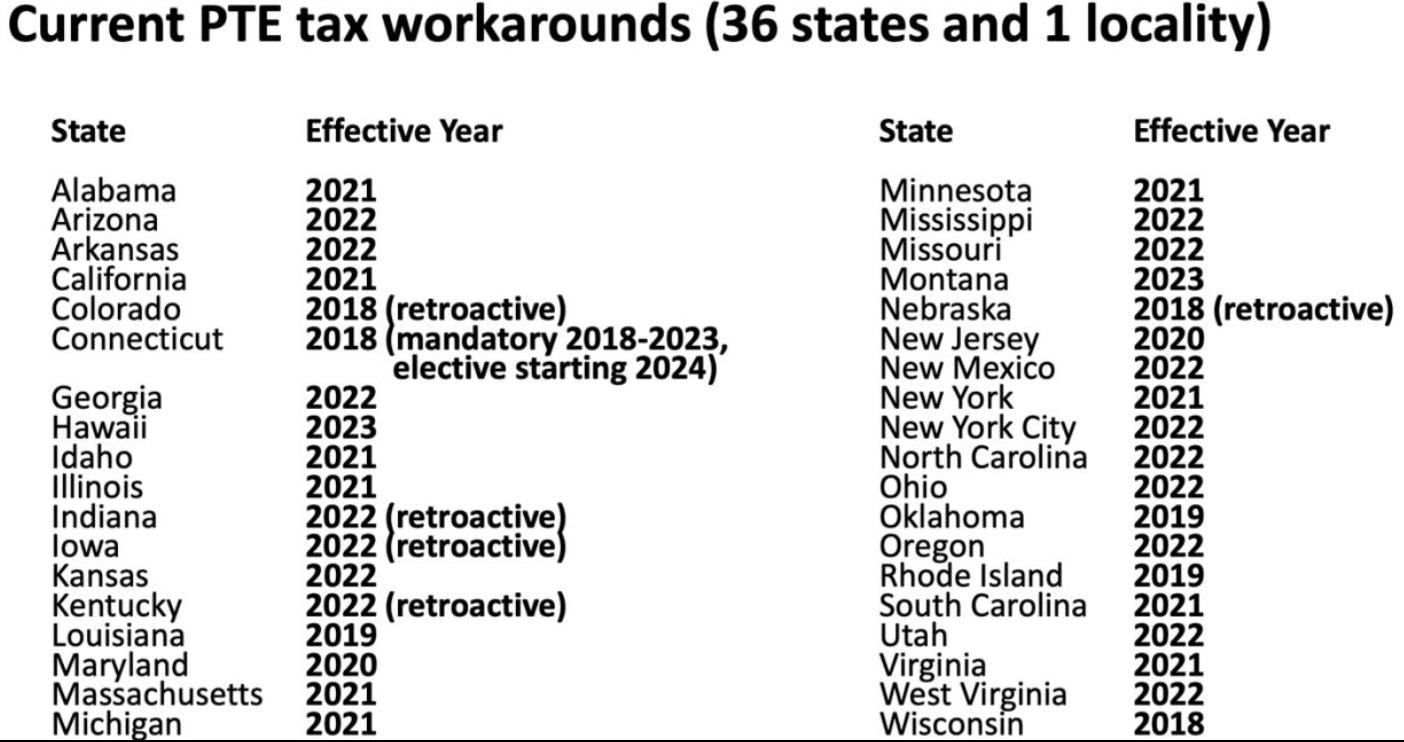

Potential Solution: The Pass-Through Entity Tax (PTET)

Owners of pass-through entities (S-corporations or partnerships) can utilize the PTET as a workaround. By electing to pay state taxes at the entity level, the business can deduct the full amount of state taxes paid as a business expense, thereby reducing federal taxable income. This strategy effectively bypasses the $10,000 SALT cap for individual taxpayers.

Example Calculation:

Let’s say you own 100% of an S Corporation in California (My Corp) and have the following income in 2025:

Net income from My Corp: $100,000

W-2 job salary: $200,000

Total taxable income: $300,000

Property taxes for primary residence: $20,000

Without PTET:

Normally, the $100,000 from My Corp is passed through to you as personal income, and you would pay California state tax at 9.3% ($9,300). However, since you already hit the $10,000 SALT cap with your property taxes, the $9,300 in state tax does not provide any federal tax benefit through itemized deductions.

With PTET:

Instead of paying the $9,300 in state tax personally, My Corp pays 9.3% of its $100,000 net income to California via PTET.

Now, your pass-through income is reduced to $91,700 ($100,000 – $9,300).

Tax Savings Calculation:

Since federal income tax is now applied to $91,700 instead of $100,000, assuming a 24% federal tax rate, you save:

$9,300 × 24% = $2,232

This means the state income tax payment created a federal-level tax deduction via PTET, effectively bypassing the $10,000 SALT cap for individual taxpayers.

My recommendations

If you own a business, this is a strategy all physicians should consider. Not all states allow PTET, so be sure to check whether your state offers this election.

3. Personal Interest Payments

Another huge source of tax waste.

Essentially, most personal interest payments do not qualify for a tax deduction. For example, interest on car loans, credit cards, and personal loans is not deductible.

Since Congress supports homeownership, they made an exception allowing mortgage interest to be deductible—but with limits.

For mortgages taken out after 2017, interest is deductible only on the first $750,000 of mortgage debt.

If you’re a baller plastic surgeon and buy a $2 million house with a $1.5 million mortgage at an interest rate of 6.66%, only the interest on $750,000 (which amounts to $49,950) is deductible. The interest on the remaining $750,000 (also $49,950) is not deductible, resulting in tax waste.

Potential Solution: Limit Your Mortgage to $1 Million

While the current deductible mortgage limit is $750,000, it is scheduled to revert to $1 million in 2026. To reduce tax waste, consider keeping your mortgage at or below $1 million if possible.

4. Charitable Contributions

The limitation here is less restrictive since we are dealing with a tax deduction for giving away money. Again, Congress implemented this rule to encourage charitable giving.

Most physicians will not face significant issues with charitable contribution deduction limits.

Cash donations are generally deductible up to 60% of AGI.

Non-cash donations generally have lower limits, as low as 20% of AGI.

For example, if your AGI is $350,000 and you make a cash donation, you can deduct up to $210,000 in charitable contributions ($350,000 × 60%).

If you donate $250,000, the excess $40,000 can be carried forward and deducted in future years as an itemized deduction, eliminating tax waste in this category.

My Recommendation

If you plan to donate a large amount of money or valuable property, first determine the charitable contribution deduction limit based on:

What you are donating (cash vs. non-cash).

The type of organization you are donating to (limits vary by recipient, as donations to most private foundations have a 20% AGI limit).

Understanding these limits ensures you maximize your tax benefit while supporting the causes you care about.

5. Casualty and Theft Losses

This provision was created to help taxpayers recover from unexpected disasters, such as a house fire or a hijacked car, by allowing them to deduct losses that were not covered by insurance.

However, the Tax Cuts and Jobs Act (TCJA) severely limited this deduction.

Currently, deductions for casualty and theft losses are allowed only if the loss was incurred due to a federally declared disaster (e.g., a California wildfire).

A Cautionary Story:

One of my real estate clients was considering buying this beautifully remodeled house where a new gas outlet had been installed without a permit by an unlicensed plumber.

I strongly warned against buying this house because if the faulty gas line caused the house to burn down, and the insurance company refused to cover the damages, the casualty loss would not be tax deductible. Thankfully, they avoided risking their life savings by walking away from the deal.

Potential Solution: No Solution — Just Pray. :)

Unfortunately, there is no workaround for this limitation.

The only option? Hope that nothing bad happens until next year, when the federally declared disaster limitation is expected to be lifted.

6. Miscellaneous Itemized Deductions

Even more limited than casualty and theft losses are miscellaneous itemized deductions, which are essentially all tax waste until 2026 due to the Tax Cuts and Jobs Act (TCJA).

What are miscellaneous itemized deductions?

Examples include:

Tax preparation fees

Unreimbursed employee expenses

Expenses related to learning more about investing

However, some states, like California, still allow miscellaneous itemized deductions to be claimed, but with a 2% AGI floor limitation.

For example, if your total miscellaneous itemized deductions amount to $10,000 and your AGI is $350,000, only $3,000 is deductible under the 2% AGI floor limitation:

$10,000 - $7,000 (2% of $350,000) = $3,000

For most physicians, miscellaneous itemized deductions provide little to no tax benefit due to their high income and the 2% AGI floor limitation.

Conclusion

Being aware of the limitations associated with itemized deductions is crucial for effective tax planning. By understanding where tax waste occurs, you can implement strategies to minimize it and make more informed financial decisions.