Burned Out? Taking a Sabbatical?

Part 1/2 – Use This Tax Strategy to Save Thousands While Taking a Sabbatical from Medical Practice!

Earlier this week, I received a question from a burned-out ER doctor, James.

“Kenny Kim, I’m so burned out. I got approval to take a sabbatical next year, but I have no idea how I’m going to fund it. Is there anything I can do to maximize tax savings?”

My first response was: “Would you consider a palliative care fellowship and transition out of ER?” (Kidding… kind of. 😆)

And my second answer was: “Of course! You should take advantage of the magical 0% capital gains tax rate!”

James replied, “What? I thought capital gains tax was always 15%.”

His reaction is a common misunderstanding, so I wrote this article to guide James—and any other physician planning a sabbatical—on how to strategically use the 0% capital gains rate to save thousands in taxes.

Sell Your Stuff TAX-FREE During Your Time Off

At the beginning of your time off, consider selling assets that have appreciated in value. This could be Tesla stock (though maybe not ideal given recent price drop thanks to Loco Elon), crypto (perhaps wait until a bull run starts), or any other investment that has gained in value.

Why?

Because when your taxable income is low (e.g., during a sabbatical year), you could qualify for the 0% long-term capital gains tax rate—saving you thousands in taxes.

How the Magic 0% Capital Gains Bracket Works

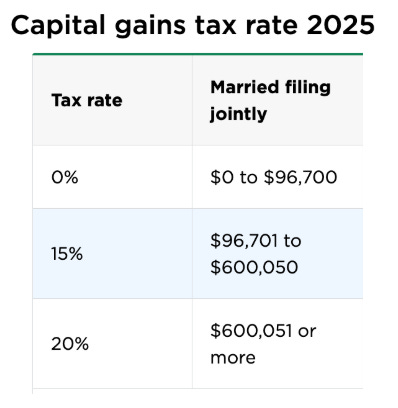

Normally, for physicians earning $400,000 in total income and filing jointly with a spouse, the capital gains tax rate is typically 15% (just as James assumed).

But not during a sabbatical year, when James would have zero earned income!

There is a 0% capital gains bracket that applies to certain taxable capital gain levels.

For James, who files married filing jointly (MFJ), up to $96,700 in taxable capital gains is taxed at 0% in 2025!

Example: James’ 0% Capital Gains Strategy

James sells NVIDIA stock for a $126,700 capital gain

He has no other income

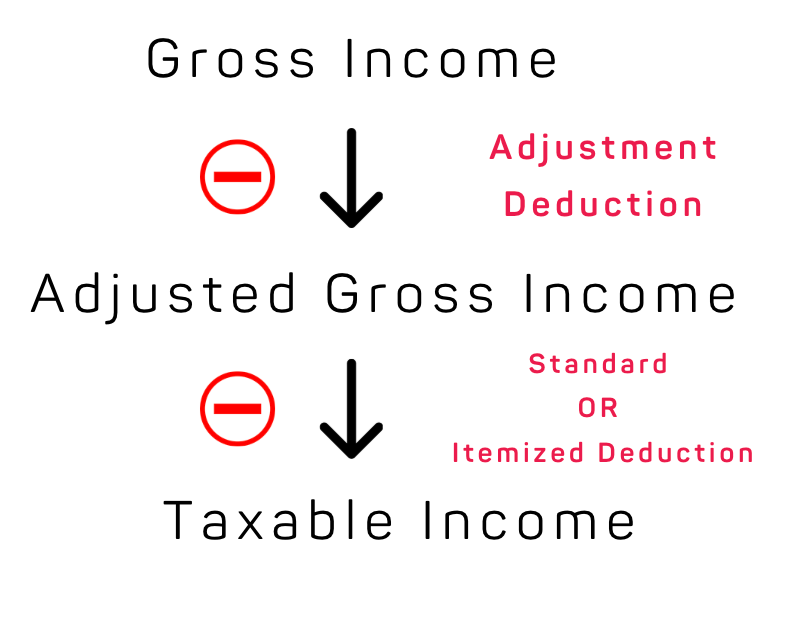

He and his spouse take the $30,000 standard deduction (Estimate)

They live in Florida (a no-state-income-tax state)

His taxable income calculation:

$126,700 (Gross Income) – $30,000 (standard deduction) = $96,700

Since $96,700 falls within the 0% capital gains bracket, his entire taxable capital gain is tax-free!

That means his full $126,700 capital gain is completely tax-free!

WOW!

James and his spouse can spend roughly $10,000 per month for an entire year—tax-free!

What If James Didn’t Know About the Magic 0% Capital Gains Tax Bracket?

Let’s assume James was unaware of this strategy and sells his NVIDIA stock at a $126,700 capital gain in 2025 while still working.

How Capital Gains Tax Is Calculated

For capital gains tax calculation purposes, capital gains ($126,700) are stacked on top of earned income ($400,000).

That means James’ first dollar of capital gain will be treated as $400,001 ($400,000 W-2 + $1 of capital gain) for determining the tax rate. Since $400,001 falls within the 15% tax bracket (as shown below), that first dollar will be taxed at 15%.

Similarly, $400,001 to $526,700 ($400,000 W-2 + $126,700 of capital gain) falls within the 15% capital gains bracket, the entire $126,700 gain is taxed at 15%.

But there’s more bad news…

Assume James’ modified adjusted gross income (MAGI) is $526,700 ($400,000 W2 + $126,700).

This means, James is subject to the Net Investment Income Tax, an additional 3.8% tax on his capital gains since his MAGI exceeds $250,000.

As a result, his entire $126,700 gain is also subject to the 3.8% Net Investment Income Tax (NIIT).

Tax Breakdown on James’ $126,700 Gain

Net Investment Income Tax (3.8%) = $4,814 ($126,700 x 3.8%)

Capital Gains Tax (15%) = $19,005

Total Tax Due = $23,819

Selling in 2025 would cost James $23,819 in taxes on his $126,700 capital gain.

Ouch!

By simply waiting until his sabbatical year in 2026, James could have saved $23,819 in taxes—enough to cover several months of expenses!

Moral of the Story: Timing matters!

What About Single Physicians?

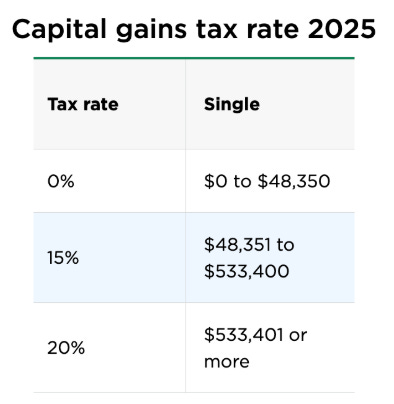

If James were single, the amount of tax-free capital gains would be lower.

0% Capital Gains Bracket for Single Filers (2025): $48,350 in taxable capital gains (as shown below)

Standard Deduction: $15,000

Total Tax-Free Capital Gains: $63,350 ($48,350 + $15,000)

This means that a single physician taking a sabbatical with no other income could have up to $63,350 in capital gains completely tax-free.

Final Thoughts: Take Advantage of the 0% Capital Gains Bracket

If you’re planning a sabbatical or a year with significantly lower income, consider selling appreciated assets during that period to take advantage of the 0% capital gains tax rate.

For married physicians: You can potentially sell up to $126,700 in investments tax-free.

For single physicians: You can sell up to $63,350 tax-free.

Pro tip: This strategy works best if you have little to no other income during that year—so plan ahead!

Disclaimer: click here