Should I Start an S Corp as an Attending with W-2 and 1099 Income?

The Math Gets Super Complicated…

This Post is Dedicated to an Amazing Mom and Physician, Dr. Sunshine

A sequel to Should I Start an S Corp as a Graduating Resident or Fellow?

Dr. Sunshine asked me the same question:

“Should I start an S corporation?”

Her situation was a bit different from Dr. Alice, a graduating fellow.

Only a couple of years out of training, She was already earning $300K in W-2 income and another $330K in 1099 income—what a rock star!

I’ll break down the tax costs vs. tax savings in her situation to determine whether an S corporation makes sense from a tax perspective.

To review how S corporation taxation works, check out “How S Corporation Taxation Works” in my previous article, Should I Start an S Corp as a Graduating Resident or Fellow?

Example: Dr. Sunshine’s Tax Scenario

Dr. Sunshine is married with one 3 yo child, and is a California resident and takes the standard deduction on her Form 1040.

Income & Expenses

W-2 salary: $300K

Locums 1099 Income: $330K

Business Expenses: $30K

Net Profit: $300K

Total Income: $600K

Option 1: 1099 Income Taxed as an S Corporation

Dr. Sunshine creates a professional corporation in California, elects S corporation status, and splits her $300K net profit as follows:

$150K salary to herself (based on reasonable compensation analysis)

$150K dividend (S corporation profit)

Taxes Owed (estimation):

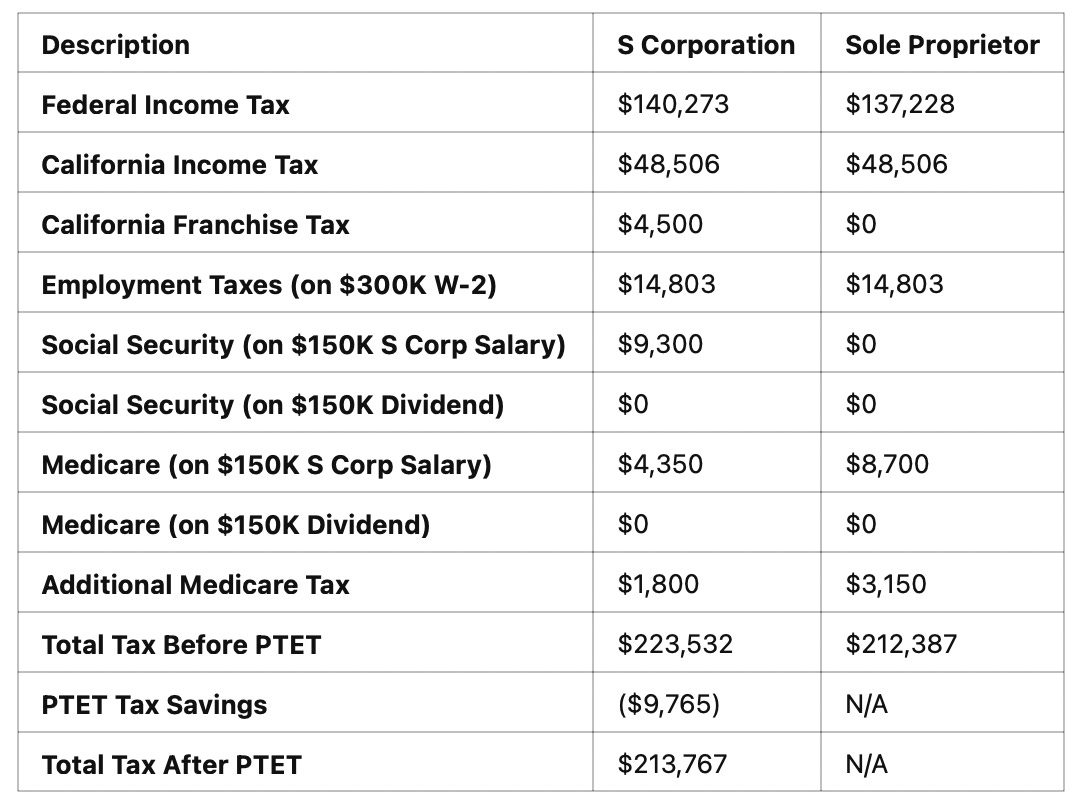

Federal Income Tax on total $600K income: $140,273

California Income Tax on total $600K income: $48,506

California Franchise Tax (1.5% of net S Corp Income, $300k): $4,500

Note: This is an additional tax she pays because of her S corporation. The annual minimum is $800, even if the business operates at a loss. Sole proprietors do not pay this tax on Schedule C income

Employment Taxes (on $300k W2 income) as an employee

Social Security: 6.2% x $168,600 (not $300K) = $10,453

Note: Although her salary is $300K, she only pays Social Security tax on the first $168,600 (Social Security wage base cap for 2024).

Medicare: 1.45% x $300K = $4,350

Total: $14,803

Self-Employment Taxes (on $150K S Corp salary and $150K S Corp dividend): as en employee and employer

Social Security on $150K salary: 6.2% x $150K = $9300

Note: This is one of the major tax costs of having an S corporation. Although Dr. Sunshine already paid her full Social Security tax from her W-2 job, her S corporation still has to pay the employer portion of Social Security tax.

Social Security on $150K dividend: 0% x $150K = $0

No social security tax on dividends

Medicare on $150K salary: 2.9% x $150K = $4350

Medicare on $150K dividend: 0% x $150K = $0

no medicare tax on dividend

Total: $13,650

Additional Medicare Tax:

0.9% x $200K = $1800

Note: The Additional Medicare Tax applies to wages exceeding $250K for Married Filing Jointly. Dr. Sunshine has $450K in wages ($300K W2 + $150K salary from S Corp).

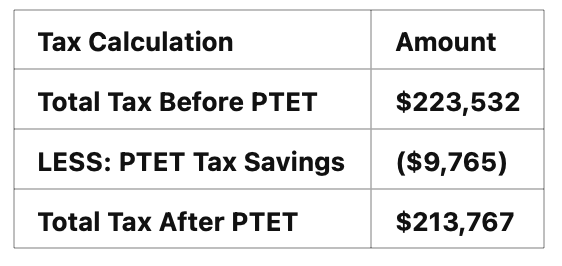

Total Tax With S Corporation: $223,532

Pass-Through Entity Elective Taxation (PTET) Strategy: The Saving Grace!

Dr. Sunshine can take advantage of California’s PTET strategy to reduce her federal taxable income, thereby lowering her total tax liability with an S Corporation.

Here’s how it works:

She elects to pay California’s 9.3% PTET tax on her S corporation’s $300K net income at the entity level.

This state tax payment becomes a federal business deduction, reducing her federal taxable income.

Since her marginal federal tax rate is 35%, this deduction results in significant tax savings as follows.

$300K × 9.3% = $27,900 (state tax paid)

$27,900 × 35% (federal tax savings) = $9,765 tax savings

Revised Total Tax Calculation With PTET (S Corporation):

Option 2: Without an S Corporation (1099 Income as a Sole Proprietor)

Her $300K locums income is taxed as a sole proprietor on Schedule C of her Form 1040.

Taxes Owed (Estimation):

Federal Income Tax on total $600K income: $137,228

This amount is $3,045 lower than Option 1 due to the 50% self-employment tax deduction ($8,700) available to sole proprietors.

California Income Tax on total $600K income: $48,506

California Franchise Tax: $0

No additional franchise tax applies because she does not have an entity.

Employment Taxes (on $300k W2 income):

Social Security: 6.2% x $168,600K (not $300K) = $10,453.

Even though her W-2 salary is $300K, she only pays Social Security tax on the first $168,600 (2024 wage base cap).

Medicare: 1.45% x $300K = $4,350

Total: $14,803

Self-Employment Taxes (on $300K 1099 income):

Social Security: 0%

No Social Security tax applies since Dr. Sunshine already paid the full Social Security tax through her W-2 job.

Medicare: 2.9% x $300k = $8,700

Total: $8,700

Additional Medicare Tax:

0.9% x $350K = $3150

Note: The Additional Medicare Tax applies to wages exceeding $250K for Married Filing Jointly (MFJ). Dr. Sunshine’s total wages are $600K, meaning $350K is subject to the extra 0.9% tax.

Total Tax Without S Corporation: $212,387

The Ultimate Tax Comparison: S Corporation vs. Sole Proprietor for Dr. Sunshine – An Analysis

Key Takeaways: S Corporation vs. Sole Proprietor

S Corporation Benefits:

The dividend portion of S corporation profit ($150K) is exempt from Social Security and Medicare taxes.

PTET: S corporation allows Pass-Through Entity Taxation (PTET), creating a business deduction that lowers federal tax.

S Corporation Costs:

California Franchise Tax: Dr. Sunshine must pay California Franchise Tax, which is 1.5% of S corporation net California income ($4,500) or a minimum of $800 annually. A sole proprietor would not pay this tax.

Additional Social Security Tax: She must also pay an additional $9,300 in Social Security tax on her S corporation salary, even though she already paid the full Social Security tax on the first $168,600 of her $300K W-2 income.

Sole Proprietor Benefits:

No Additional Social Security Tax: Dr. Sunshine does not have to pay extra Social Security tax on her 1099 income since she already paid the full Social Security tax on the first $168,600 of her $300K W-2 income.

No California Franchise Tax: As a sole proprietor, she has no entity, so she does not have to pay the 1.5% California Franchise Tax or the $800 minimum annual fee that an S corporation would.

Self-Employment Tax Deduction: She can deduct 50% of her self-employment tax against her federal taxable income, which reduces her federal tax liability.

Sole Proprietor Costs:

Higher Medicare Tax: The entire $300K of 1099 income is fully subject to self-employment tax, whereas $150K of it would have been exempt from Medicare tax under an S corporation.

Higher Additional Medicare Tax: A sole proprietor pays $3,150 in Additional Medicare Tax, compared to $1,800 under an S corporation, because S corp dividends ($150K) are not subject to Medicare tax.

Additional Costs of Having an S Corporation

Beyond taxes, running an S corporation comes with additional administrative costs that can add up:

Business Formation & Compliance Costs:

Legal fees for incorporation ($500–$2,000)

Annual report filing fees ($25–$100, depending on the state)

Payroll Processing Fees:

Since S corporations require a reasonable salary, payroll services are needed (~$1,000 per year).

Tax Preparation Fees:

S corporations must file a separate Form 1120-S tax return, which can cost $1,500–$3,000 from a reputable CPA.

Final Verdict: S Corporation vs. Sole Proprietor: Which Comes Out Ahead?

When factoring in both tax and administrative costs, a sole proprietorship comes out ahead for Dr. Sunshine purely from a tax perspective.

However, for Dr. Sunshine, who is juggling many responsibilities and is expected to accumulate significant wealth in the coming years, the S corporation structure may still be worth considering due to its audit protection (headache reduction) and liability protection. The audit rate for an S corporation is about 90% lower than that of a sole proprietorship.

Final Thoughts: Making the Right Choice for Dr. Sunshine

While the current tax analysis suggests that staying a sole proprietor may be the better option for now from a tax perspective, Dr. Sunshine should consider more than just immediate tax savings when deciding whether to elect S corporation status.

Her future income projections, risk tolerance, and comfort level with compliance requirements all play a role in determining the best structure for her business.

Additionally, tax laws change, and income fluctuates, so running the numbers annually is essential to ensure that Dr. Sunshine is always using the most advantageous tax strategy for her financial success!

Disclaimer: click here