Should I Start an S Corp as a Graduating Resident or Fellow?

It all depends on your 1099 gig profit!

This Post is Dedicated to a Future Rockstar Physician, Dr. Alice.

“Should I start an S corporation?”

I often get this question from graduating residents and fellows who hustle, do locums, and earn 1099 income while also receiving W-2 wages from their training.

My first answer is: “It depends on how much you make from your 1099 gig.”

Why?

Because starting and maintaining an S corporation costs money—potentially thousands of dollars per year. You have to weigh those costs against the tax savings an S corporation can provide.

In the end, it all comes down to tax costs vs. tax savings.

Note: This discussion will focus only on the tax aspects of an S corporation, not any potential legal benefits.

First, Let’s Talk About Tax Savings (The Good News!)

In short, S corporations create tax savings by allowing a portion of their net profit (called distributions or dividends) to be exempt from Social Security and Medicare taxes.

I know—many of you are probably thinking, “What the heck is Kenny Kim talking about?”

Let me break it down.

How S Corporation Taxation Works

First, Dr. Alice would calculate her S corporation’s net profit by subtracting business expenses (excluding her salary) from the corporation’s total income.

Then, she would split the net profit into two buckets as follows.

Bucket #1: Salary to Herself

This is the amount she pays herself as an employee of her S corporation. (Yes, it may feel weird since she owns 100% of the corporation, but legally, the S corp is a separate entity.)

The salary must be reasonable—meaning it should be an amount she would pay another physician for similar work in a similar situation. This is known as reasonable compensation.

This salary is taxed like any other W-2 income, meaning it is subject to:

Federal and state income taxes

Social Security and Medicare taxes (FICA taxes)

Bucket #2: Dividends – The Remaining Profit

This is the S corporation’s remaining profit after paying all expenses, including her salary. This is where the key tax benefit comes in - dividends are not subject to Social Security or Medicare taxes. However, they are still subject to federal and state income taxes.

In summary, tax savings come from the second bucket—dividends, which are not subject to social security tax (12.4%) and medicare tax (2.9%, or 3.8% if the Additional Medicare Tax applies)

Example: Dr. Alice’s Tax Scenario

Dr. Alice is considering forming an S corporation for her locums work. She is a single, a California resident and takes the standard deduction ($15K) on her Form 1040.

Income & Expenses

Locums 1099 Income: $90K

Business Expenses: $10K

Net Profit: $80K

W-2 fellowship salary: $80K

Total Income: $160K

Option 1: With an S Corporation

Dr. Alice elects S corporation status and splits her $80K net profit into:

$40K salary to herself (reasonable compensation)

$40K dividend (S corporation profit)

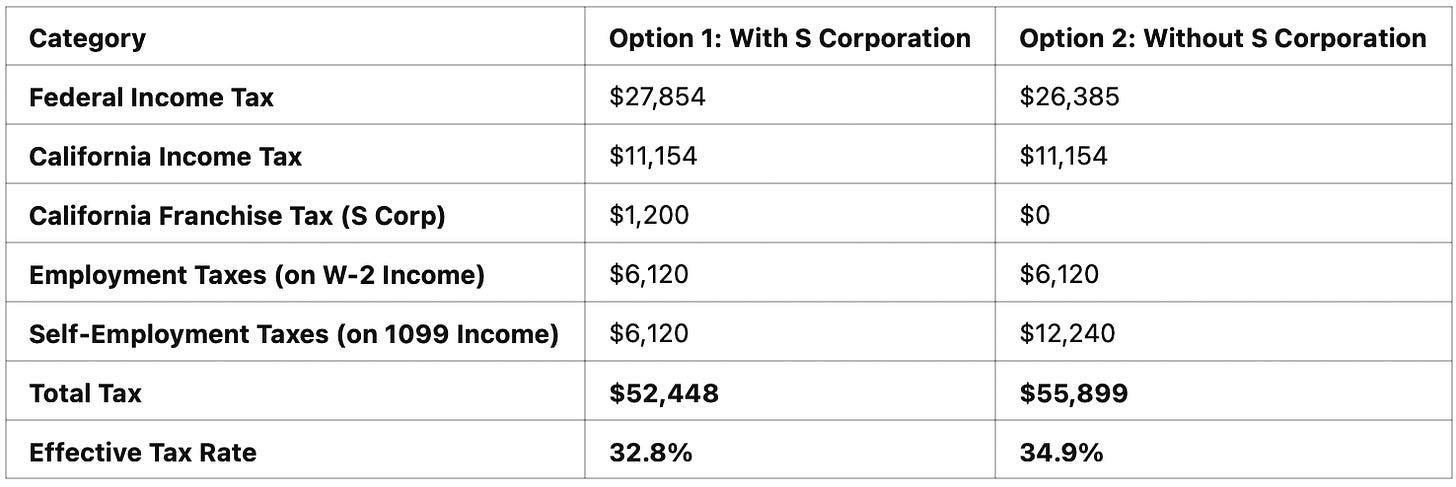

Taxes Owed:

Federal Income Tax (on total $160K income): $27,854

California Income Tax (on total $160K income): $11,154

California Franchise Tax (for S Corp): $1,200

Employment Taxes (on $80k W2 income):

Social Security: 6.2% x $80K = $4,960

Medicare: 1.45% x $80K = $1,160

Total: $6,120

Self-Employment Taxes (on $40K salary and $40K dividend):

Social Security on $40K salary: 12.4% x $40K = $4,960

Social Security on $40K dividend: 0% x $40K = $0

Medicare on $40K salary: 2.9% x $40K = $1,160

Medicare on $40K dividend: 0% x $40K = $0

Total: $6,120

Total Tax With S Corporation: $52,448

Option 2: Without an S Corporation (1099 Income as a Sole Proprietor)

Her $80K locums income is taxed as a sole proprietor on Schedule C of her Form 1040.

Taxes Owed:

Federal Income Tax (on $160K income): $26,385

$1469 less compared to Option 1 due to 50% self-employment tax deduction ($6120)

California Income Tax (on total $160K income): $11,154

California Franchise Tax: $0

Employment Taxes (on $80k W2 income):

Social Security: 6.2% x $80K = $4,960

Medicare: 1.45% x $80K = $1,160

Total: $6,120

Self-Employment Taxes (on $80K 1099 income):

Social Security: 12.4% x $80k = $9,920

Medicare: 2.9% x $80k = $2,320

Total: $12,240

Note: This is double the employment taxes since she has to pay those taxes both as an employee and employer.

Total Tax Without S Corporation: $55,899

Tax Savings Breakdown

Total Tax Savings with S Corporation: $3451

*Note that the Qualified Business Income (QBI) Deduction—available to both Option 1 and Option 2—and the $10,000 State and Local Tax (SALT) cap workaround via Pass-Through Entity Elective Taxation—only available to Option 2—are excluded from this calculation. The math can be quite complicated, and these provisions are expected to expire at the end of 2025.

Where Do the Savings Come From?

Dr. Alice avoids paying Social Security and Medicare taxes on the $40K in S corporation dividends, which provides her with the most significant tax savings.

However, she pays slightly more in federal income tax with an S corporation because a sole proprietorship allows her to claim a self-employment tax deduction. Additionally, as an S corporation owner, she is required to pay the California Franchise Tax.

Now, Let’s Talk About the Costs (The Bad News)

Running an S corporation is not free—it comes with ongoing costs that can reduce tax savings:

Business Formation Costs: In California, the state filing fee is $125. However, Dr. Alice will have to pay for the incorporation paperwork. It can be done can be $300-500 if using LegalZoom or if she hires a business attorney, it can be $2,000+.

Payroll Processing Fees: Dr. Alice must pay herself a salary, which typically requires a payroll service (~$1,000 per year)

Tax Preparation Costs: Filing an S corporation tax return costs $1,000–$3,000 from a reputable CPA.

State Taxes: Dr. Alice now has to pay the State of California in addition to the state income tax. The annual minimum Franchise Tax is $800 (waived in the first year) but it can be as high as 1.5% S Corp Net Profit (e.g., $1,200 on $80K profit).

Corporate Formalities: This may not cost money, but it requires effort. Dr. Alice must hold corporation meetings and maintain minutes. She is recommended to have a board of directors and hold board meetings, and she must maintain separate business and personal finances to preserve liability protection that the S Corporation provides.

Estimated Year 1 Costs: $3,000+

Since Dr. Alice can save approximately $3,451 in taxes but would spend over $3,000 to maintain her S corporation, it may or may not be worth it. She should run the numbers before deciding.

Final Thoughts: Should Dr. Alice Form an S Corporation for Tax Purposes?

The decision comes down to the tax savings vs. costs.

Primary Benefit: Avoid Social Security & Medicare tax on S corp dividends.

Primary Cost: Legal, payroll, and tax filing fees.

A general rule of thumb for Dr. Alice that if her 1099 net profit is below $80,000, the potential tax savings may not justify the costs. However, if her profit far exceeds $80,000, forming an S corporation could be a worthwhile decision.

Bottom Line: Do the math before forming an S corporation!

Disclaimer: click here