How Much Do I Get to Keep If I Work an Extra $2,000 Shift?

A Simple Way to Calculate How Much Uncle Sam, Uncle Cali, and Team Welfare Take from Your Paycheck

Is it worth picking up another ED shift that pays 1.5x my rate?

I used to ask myself this question all the time when I started working as an attending —because I had a ton of student loan debt and was hungry. 🙂

I want to share a quick calculation I used to figure out how much of that extra shift’s pay you will actually keep.

To do this, you need to understand that your shift earnings will be subject to three types of taxes:

Federal income tax

State income tax

Welfare taxes (aka payroll taxes)

Let’s break them down so you can quickly do the math in your head before clicking “Send” on that email saying, “Yes, I’ll pick up that shift.”

Federal Income Tax

Federal income tax is the big boss of the three taxes.

It is calculated based on federal taxable income, using the following core formula:

Gross Income – Adjustments = Adjusted Gross Income (AGI)

AGI – Deductions = Taxable Income

(See: realtaxdoctork.com/p/90-of-physicians-dont-know-this-essential for details.)

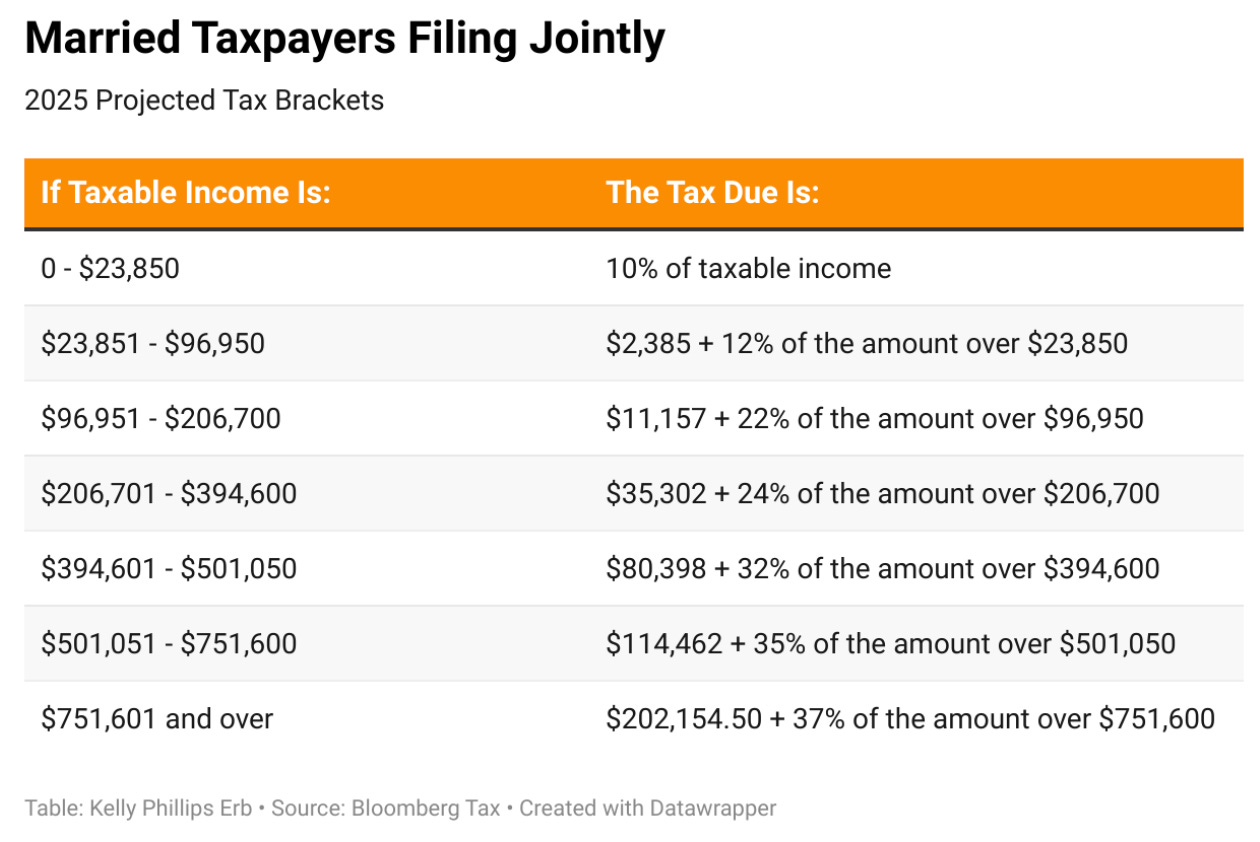

Once you determine your taxable income, you apply the federal tax brackets to calculate your tax liability based on your filing status.

For example, let’s say you are married filing jointly, and your household taxable income is $394,600.

Let’s calculate your federal income tax liability for 2025:

The first $23,850 is taxed at 10%.

The next $73,101 (from $23,851 to $96,950) is taxed at 12%.

The next $109,749 (from $96,951 to $206,700) is taxed at 22%.

The remaining $187,899 (from $206,701 to $394,600) is taxed at 24%.

Your total federal income tax liability is $80,398.

Now, if your household taxable income without picking up extra shifts is $394,600, any additional income - such as earnings from an extra shift - will be taxed at 32%.

So, if you earn $2,000 from working an extra shift, you will pay $640 (32%) extra in federal income tax to Uncle Sam.

State Income Tax

In addition to federal income tax, you’ll also need to account for state income tax, unless you live in a state with no state income tax.

Each state has its own method of calculating taxable income, but most use federal Adjusted Gross Income (AGI) as a starting point. Once you determine your federal AGI, you apply state-specific adjustments, deductions, and exemptions to calculate your state taxable income. Then, just as you did for the federal income tax liability calculation above, you apply the state’s tax rates to determine your state income tax liability.

How is this calculated?

Assuming a taxable income of $394,600 in California, let’s calculate your California income tax liability for 2025 (*based on 2024 brackets):

The first $21,512 is taxed at 1% => $215

The next $29,486 (from $21,512 to $50,998) is taxed at 2% => $589

The next $29,492 (from $50,998 to $80,490) is taxed at 4% => $1,179

The next $31,242 (from $80,490 to $111,732) is taxed at 6% => $1,874

The next $29,480 (from $111,732 to $141,212) is taxed at 8% => $2,358

The remaining $253,388 (from $141,212 to $394,600) is taxed at 9.3% => $23,565

Your total California income tax liability is $29,780.

How an Extra Shift is Taxed in California

If your household taxable income without picking up extra shifts is $394,600, any additional earnings will be taxed at 9.3% in California until your taxable income reaches $721,318.

That means, if you make $2,000 from an extra shift, you will pay $186 (9.3%) in state income tax to Uncle Cali.

Total Taxes on Extra $2,000 Shift Earnings so far.

Federal: $640

CA: $186

Total: $826

Thus, after taxes, you keep $1,174 of the $2,000 extra shift earnings.

Payroll Taxes

Unfortunately, federal and state income taxes aren’t the only taxes you need to consider. You also have welfare tax liability (payroll taxes), which mainly consists of Social Security and Medicare taxes.

Social Security Tax

Social Security tax is imposed on the first $176,100 in earnings in 2025 (adjusted annually for inflation). The tax rate is 12.4%, split equally between employer and employee (6.2% each). This means the maximum Social Security tax that an employee pays in 2025 is $10,918. Even if you earn $1 million in salary, your Social Security tax is capped at $10,918.

Medicare Tax

Unlike Social Security tax, Medicare tax is imposed on all earnings with no wage cap. The standard Medicare tax rate is 2.9%, split equally between employer and employee (1.45% each). Additionally, there is an extra 0.9% Medicare tax on earnings exceeding:

$200,000 for single filers

$250,000 for married couples filing jointly

This extra 0.9% tax is paid only by the employee.

Example Calculation

Let’s say a couple’s taxable income is $394,600.

For W-2 employees, Social Security and Medicare taxes are imposed on total wages, not taxable income. That means deductions and adjustments must be added back to taxable income.

Assume the couple took a standard deduction of $30,000 and had no adjustments, their wages subject to welfare taxes would be:

$394,600 + $30,000 = $424,600

Social Security Tax Calculation

Social Security tax is capped at the first $176,100 in earnings, so you will pay: $176,100 × 6.2% = $10,918

Medicare Tax Calculation

Medicare tax applies to all $424,600:

Standard medicare tax: $424,600 × 1.45% = $6,156

Additional 0.9% Medicare tax on income over $250,000 (MFJ)

$174,600 ($424,600 - $250,000) × 0.9% = $1,571

Total Medicare tax: $6,156 + $1,571 = $7,727

Total Welfare Taxes (Social Security + Medicare)

$10,918 + $7,727 = $18,645

How an Extra Shift is Taxed for Payroll (Welfare) Taxes

if you make $2,000 from an extra shift, you will be taxed:

0% Social Security Tax

1.45% Medicare tax

0.9% additional Medicare tax

Totaling 2.35% on $2,000 = $47 to “Team Welfare”

Final Breakdown of Taxes on Extra $2,000

Federal Income Tax (32%): $640

CA Income Tax (9.3%): $186

Medicare Tax (2.35%): $47

Total Taxes: $873

After taxes, you keep $1,127, which is 56% of what you earned.

Note: California also assesses a 0.9% State Disability Insurance (SDI) tax, but it is not included here for simplicity.

Bottom Line

Before clicking “Send” on that email saying, “Yes, I’ll pick up that shift,” take a moment to calculate how much of your earnings you’ll actually keep after taxes to decide whether it’s worth it.

By doing this calculation repeatedly, you’ll develop a clearer understanding of how federal income tax, state income tax, and payroll (welfare) taxes are calculated. This knowledge is not only essential for determining whether picking up an extra shift makes financial sense, but also for gaining insight into the mechanism of tax-saving strategies that can help reduce your overall tax liability.