“Damn, Kenny Kim. I missed the extension deadline yesterday. The IRS is going to charge me a pretty penny in penalties. What can I do now?!”

That was Dr. G Bladder, a general surgeon colleague, venting after he missed submitting his tax extension to push the filing deadline to October 15th. He had just come off a brutal week of being on call, covering for multiple sick colleagues. I genuinely felt bad for him. Being a surgeon is already stressful enough, and now a missed the extension deadline was just piling on more pressure.

I told him, “no worries brotha. I got you. Let me tell you what you can do to get that penalty waived.”

In this article, I’ll break down exactly what happens when Dr. G Bladder miss the extension deadline - and more importantly, what he can do to fix it.

If you are in the same boat, just follow what Dr. G. Bladder did.

First: The Penalty Hits Hard

We all know the tax filing deadline is April 15. If you don’t file by then and haven’t requested an extension, the IRS will assess a failure-to-file penalty.

How much?

It’s 5% of your unpaid tax per month, up to a maximum of 25% of what you owe.

Since Dr. G. Bladder didn’t file his tax return by April 15 and didn’t submit an extension request on time, the IRS will hit him with this penalty.

And get this: even if he is just one day late, the IRS will charge the full 5% for that month.

Yeah. Ouch.

Let’s say Dr. G. Bladder owes $10,000.

One day late? That’s a $500 penalty.

Each month that passes? Another $500 gets tacked on, until the penalty hits the maximum of $2,500 (25%)

And nope, this penalty is not tax-deductible.

But Wait - There’s Another Penalty

The Failure-to-File penalty has a little sibling: the Failure-to-Pay penalty.

This one only kicks in if you owe taxes - so if you overpaid or are due a refund, you are in the clear (thank goodness)!

Here’s how it works: even if you filed an extension, any taxes owed are still due by April 15. An extension gives you more time to file, not more time to pay. If you don’t pay by then, the IRS will charge a Failure-to-Pay penalty of 0.5% per month on the unpaid balance.

Now, here’s a little silver lining:

If both the Failure-to-File and Failure-to-Pay penalties apply, the combined penalty is capped at 5%, 5.5%.

Now for the Good News (Yes, There Is Some)

Dr. G. Bladder has been a responsible taxpayer over the years - he filed and paid his taxes on time and has never had any penalties assessed. For a “good boy” like Dr. G. Bladder, the IRS may give him a break through something called First-Time Penalty Abatement (FTA).

Think of it as a one-time “we’ll let it slide” deal - but like any good deal, there are a few rules you need to meet.

Does Dr. G. Bladder Qualify for First-Time Penalty Abatement?

To qualify, he’ll need to meet all three of the following criteria:

Clean penalty record: No penalties in the prior three years (check!)

Up-to-date tax filing : All required returns must be filed - including the one he is late on now. Filing an extension counts too.

No shady stuff: No signs of fraud, intentional neglect, or anything that screams, “I tried to cheat the IRS.” (And let’s be real - Dr. G. Bladder is way too “good of a boy" for that).

Two Ways Dr. G. Bladder Can Request First-Time Penalty Abatement

Since Dr. G. Bladder meets all three eligibility criteria, he has two ways to request First-Time Abatement.

Option 1: Call the IRS After Receiving a Notice

Once Dr. G. Bladder receives an IRS notice assessing the penalties, he can:

Call the IRS using the phone number listed on the notice and request FTA over the phone.

Heads up: It may take weeks—or even months—to get that notice. And when he finally calls, he should be prepared for a long wait on hold (IRS staffing is, well… a lot like hospitals these days— very understaffed, thanks to DOGE!).

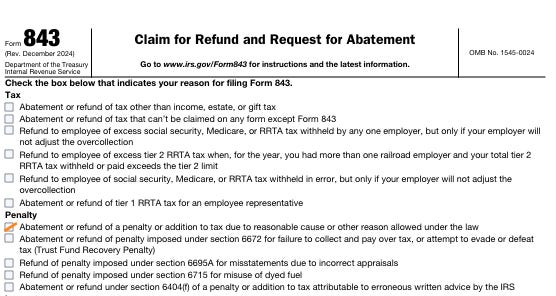

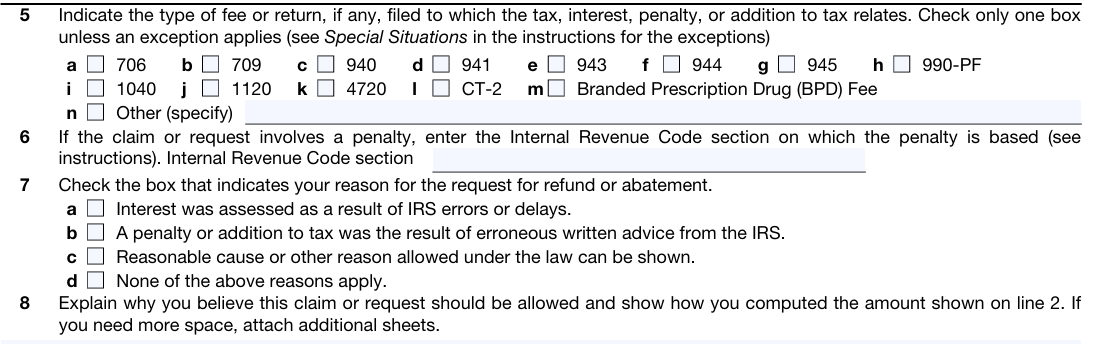

Option 2: File Form 843 (Request for Abatement in Writing)

He can also submit a written request by filing Form 843 and mailing it to the IRS service center where he filed his return.

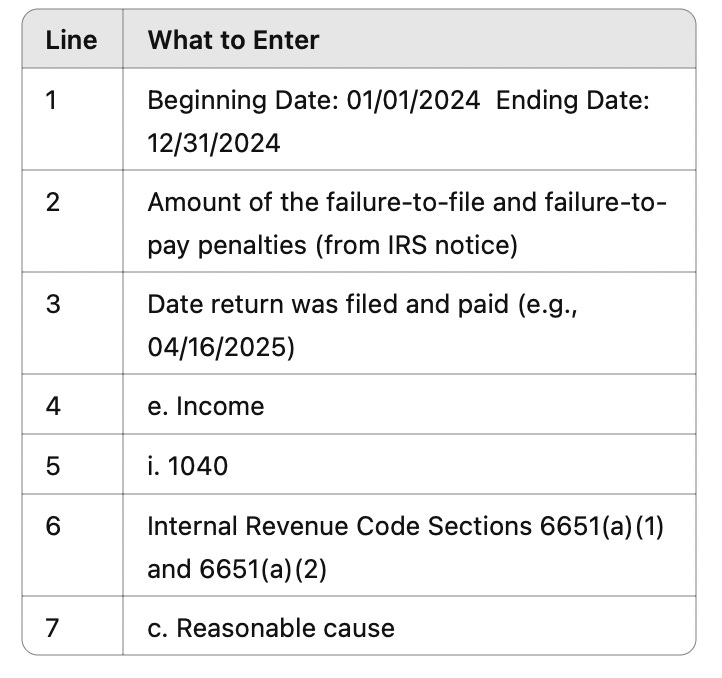

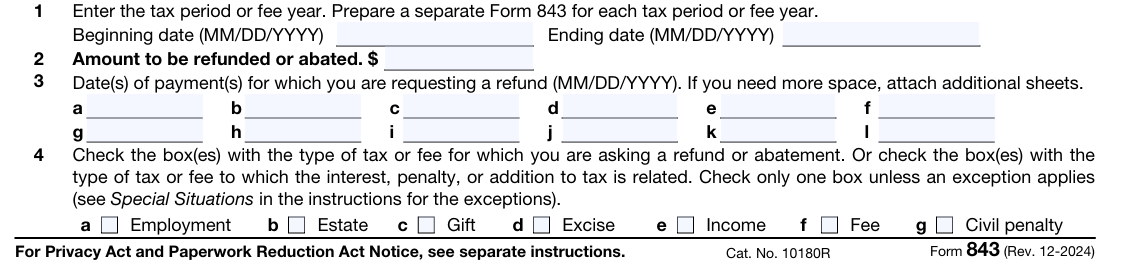

Instructions for Completing Form 843:

Check the first box under “Penalty.”

Complete Lines 1 through 7 as follows:

Line 8 – Reasonable Cause Statement:

I am requesting First-Time Abatement (FTA) of the failure-to-file and failure-to-pay penalties for tax year 2024, under the IRS’s administrative relief policy outlined in IRM 20.1.1.3.3.2.1.

I meet the FTA qualifications as follows:

I have a clean penalty history—no penalties for the three years prior to 2024.

All required tax returns have been filed.

The tax due for 2024 has been fully paid.

Reminder: It may take several months for the IRS to process the request—so patience is key!

My Advice? Pay the Penalties Now, Then Ask for a Refund

The smart move?

Go ahead and Pay the penalty now - and submit Form 843 at the same time.

Once the IRS processes the form and approves the First-Time Abatement, Dr. G. Bladder will receive a refund of the penalty he already paid.

Paying upfront helps him avoid the stress of IRS notices piling up on his kitchen table, demanding payment while the IRS takes its sweet time reviewing his abatement request.

Bottom Line

One little form—Form 843—and a simple, well-worded explanation could save Dr. G. Bladder hundreds of dollars and a whole lot of stress. With that money, he could snag G-Dragon’s latest album, stock up on exotic gallbladder-friendly fruits from Whole Foods, and even treat himself to a well-earned massage to melt away the stress of nonstop call shifts.

Hope this was therapeutic. :)

Disclaimer: click here