My Kid Got a Scholarship! Is It Tax-Free?

3 Rules You Must Know to Determine If a Scholarship Is Tax-Free

“Kenny Kim, my daughter, Kumon, got a full ride to Claremont McKenna College!”

Dr. Tiger-Mom shared this great news with me.

Dang, Claremont’s tuition alone is $71,700 this year. That means she probably saved about $100,000!

In theory, Dr. Tiger-Mom could cut down her clinical work by 50% because she no longer has to pay $100,000 in college expenses—expenses that would have required her to generate roughly $200,000 in clinical income (after taxes).

She asked me whether her daughter’s full ride would be fully tax-free.

My answer was: “It depends.”

In order for the full ride to be completely tax-free, the perfect “combo” is required—just like ruling out a PE via the PERC rule, instead of doing a CT - all historical and objective criteria must be met.

In this article, I’ll cover the three objective criteria that must be satisfied for Kumon’s full ride to Claremont to be treated as a tax-free scholarship.

The Overarching Rule

A scholarship is tax-free if the money is:

Used for qualified tuition and related expenses,

Paid to a qualified educational institution to pursue a degree, and

Not compensation for services that the student provides.

Let’s dive into each.

#1. Qualified Tuition and Related Expenses

Scholarship funds must be used to pay for tuition and fees required for enrollment or attendance, plus related expenses such as books, supplies, and equipment required for courses.

Tuition and fees required for the enrollment or attendance are pretty self-explanatory.

Related expenses are where things can get a bit tricky to discern.

Whether they are tax-free hinges on the word, “required”.

If a textbook is listed as optional on the course syllabus, then using scholarship funds to buy it would make that portion taxable. Kumon should only use scholarship money for required course materials.

While room and board may be perceived as necessary expenses, they are not considered as required expenses. So, if Kumon uses her scholarship money to pay for housing or food, that portion is taxable to her.

#2. Qualified Educational Institution

The scholarship must be used at a qualified educational organization. Without even looking up the definition, most people would assume Claremont McKenna qualifies—and that’s correct.

A qualified organization is one that:

Maintains a regular faculty and curriculum,

Has an enrolled student body, and

Offers educational activities regularly.

If Kumon used the scholarship to take an online course from a YouTuber, that expense would not qualify—and would be taxable.

#3. Not a Compensation for Services

Kumon’s scholarship was based on her excellent academic achievement. So, her scholarship did not require her to perform any services, like tutoring or working in the dining hall - she just has to maintain a certain GPA and make progress towards her degree.

If her scholarship required her to work as a tutor as a condition, then the portion of the scholarship that corresponds to the value of her tutoring services would count as taxable compensation. In that case, Claremont would likely issue a W-2, and Kumon would report that income on her Form 1040.

So, it is important to read the fine print outlining the conditions for receiving the scholarship.

Of note, there are a few narrow exceptions - for example, Armed Forces Health Professions Scholarships allow the student to provide services without having the scholarship taxed.

What About Athletic Scholarships?

Are those considered compensation for being an athlete and therefore taxable?

Not necessarily.

An athletic scholarship can still be tax-free as long as the student is free to leave the athletic program at any anytime, for any reason, without losing the scholarship. So, if the scholarship has no strings attached and the other criteria are met, it can still qualify as a tax-free scholarship.

Tax-Free vs Taxable Scholarships: Kumon’s Scholarship Example

Given these rules, let’s look at how Kumon’s scholarship is treated for tax purposes.

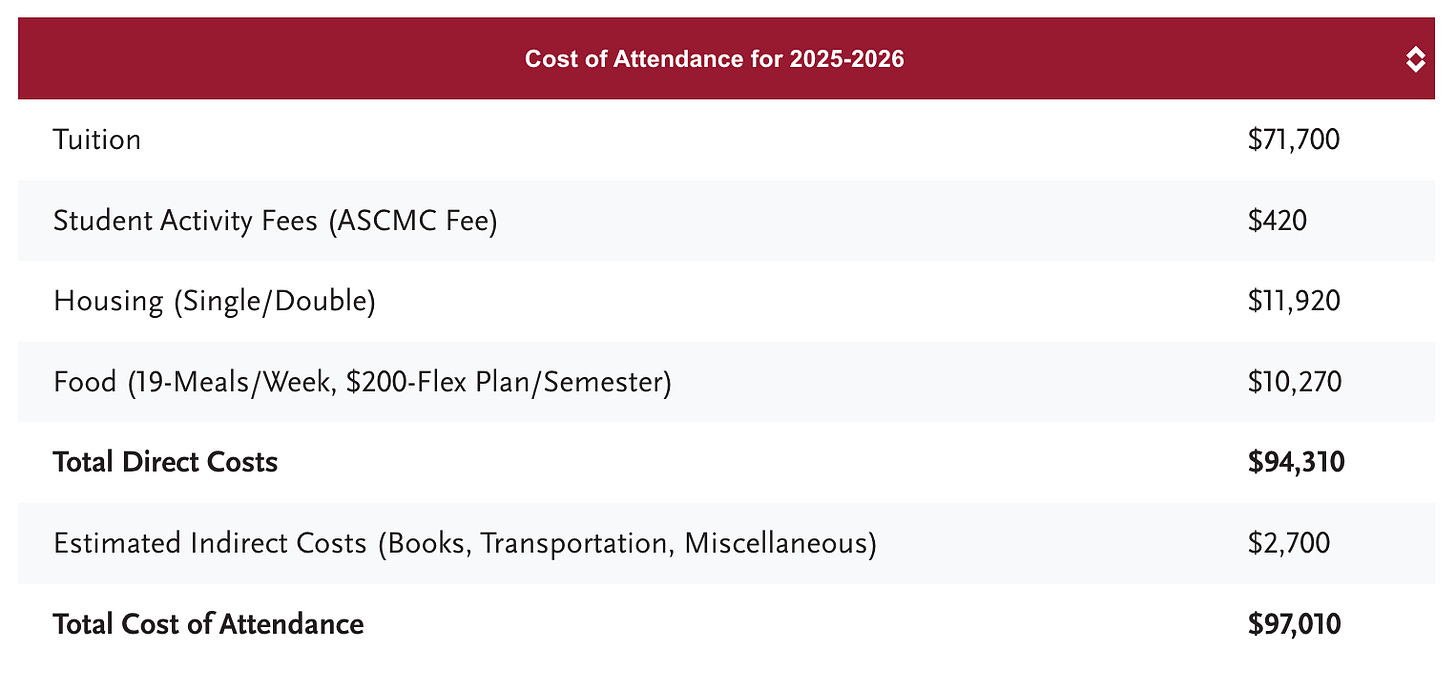

Below is the cost of attendance for Claremont for the current academic year.

Let’s apply the above criteria to the costs listed above.

Tuition: $71,700 – Tax-free under Rule #1.

Student Activity Fee Required for enrollment: $420 – Tax-free under Rule #1.

Housing: $11,920 – Part of room and board – Taxable.

Food: $10,270 – Also room and board – Taxable.

Indirect Costs:

Required books - Tax-free under Rule #1.

Transportation (e.g., gas to commute): Not a qualified expense, so taxable.

Assuming her scholarship totals $97,010, the taxable portion would be:

$11,920 (housing) + $10,270 (food) = $22,190 taxable to Kumon.

The portion of indirect costs (e.g., transportation) is also taxable to Kumon

$71,700 in tuition and student activity fee $450 will be tax free since they meet rule #1, #2, and #3,

In summary, even with a “full ride” scholarship, about 20% of Kumon’s scholarship is taxable, while the vast majority remains tax-free!

Final Thoughts

Not all scholarships are tax-free.

To qualify, the scholarship must be used for:

Qualified tuition and related expenses

At a qualified institution

While pursuing a degree

And must not be compensation for services like tutoring or working in the cafeteria.

Coming up next: I’ll walk through how the $22,190 taxable portion of Kumon’s scholarship is actually taxed under the kiddie tax rules.

Disclaimer: click here