How to Pay No Federal Income Tax During Residency!

But you might need a suga mama or suga daddy

You’ve probably heard some ridiculous claims from tax “gurus” that they can wipe out 99% of your income tax!

Most of those guys are coo-coo.

On the other hand, my claim that I can wipe out 100% of your federal income tax is technically possible—though not very realistic unless you’ve got a suga mama or daddy to support you.

Let me explain what I mean.

First, you need to understand how federal income tax is calculated to determine my claim of wiping out 100% of your federal income tax bill is legitimate or B.S.

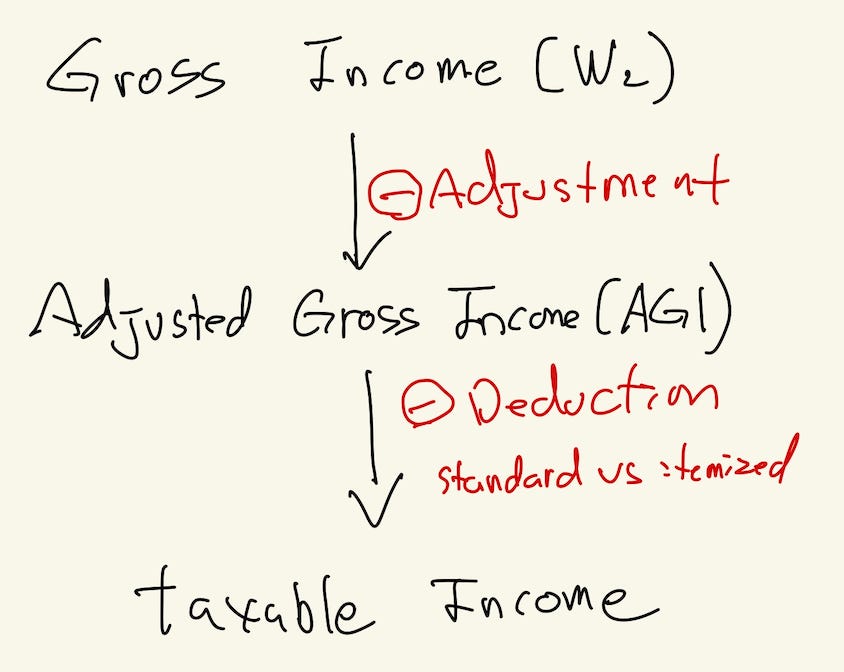

So, let me first review the most basic formula for calculating individual income tax:

1. Start with gross income.

2. Subtract adjustments to arrive at adjusted gross income (AGI).

3. Subtract deductions (either standard or itemized) to calculate taxable income.

Here’s an Example

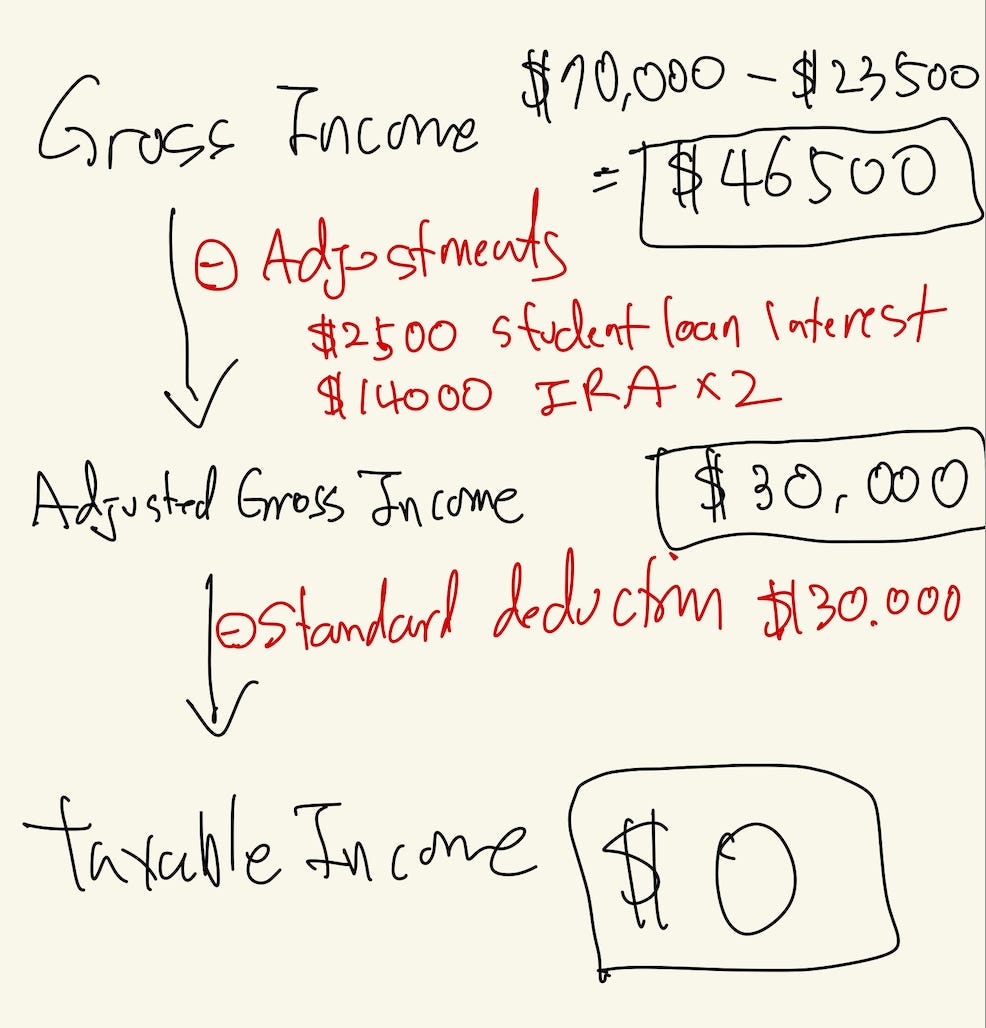

Let’s assume your residency program pays you $70,000 as your salary and that you’re not making money elsewhere.

Now let’s say you:

• Contribute $23,500 to your 403(b) retirement account via elective deferral.

• Contribute $7,000 to a traditional IRA for yourself and your non-working spouse, for a total of $14,000.

• Pay $2,500 in student loan interest for the year.

Now, let’s calculate your taxable Income.

1. Start with your salary of $70,000, which is your gross income.

• Your 403(b) contribution of $23,500 reduces your gross income to $46,500.

2. Apply additional adjustments:

• Your traditional IRA contribution of $14,000 and student loan interest payment of $2,500 are adjustment deductions that further reduce your income.

• Your adjusted gross income (AGI) is now $30,000 ($46,500 - $14,000 - $2500)

3. Subtract the standard deduction:

• Since you are married filing jointly, your standard deduction is $30,000. Assuming you don’t own a fancy house with a mortgage, you’ll likely take the standard deduction (as opposed to itemized deduction) which reduces your taxable income to $0.

Congratulations—you owe no federal income tax!

Unlike other tax gurus, I’m not going to stop there.

Let me give you the full picture: while you have no federal income tax liability, you still have other taxes to pay - you will still owe Social Security and Medicare taxes (FICA), which total 7.65% of your W-2 income. On a $70,000 salary, that’s approximately $5,400.

The Reality Check

It’s great that you pay no federal income tax by making retirement contributions and paying student loan interest. But here’s the catch: you’ll only have $30,000 left to spend while still needing to cover bills like rent, utilities, groceries, and other expenses. It’s unlikely to cover all your bills —unless you’ve got a suga mama or daddy helping with the bills

So while achieving $0 federal income tax is possible on paper, it’s not a realistic strategy for most residents.

The Key Takeaway

Claiming that I can teach you how to pay zero federal income tax was a bit of clickbait. My real goal was to teach you how to calculate your taxable income using the following formula

Gross income - Adjustments - Deductions = Taxable income.

Your tax bill is calculated based on taxable income.

It’s a simple formula, but understanding it will become critically important when you later apply various tax strategies later to ultimately lower your tax bills as an big ballar attending.

Disclaimer

One of my heroes, Mel Herbert, MD, founder of EM-RAP, may have once said:

“Don’t just do something, stand there.”

That would be my advice to you after reading my blog—stand there (for now) and don’t do anything (yet).

Why?

While I am a tax professional, I am not your tax professional. I do not know your particular situation, and tax matters can be complex. What works for one person may not work for another.

Before taking action, assess your situation and consult with your tax professional to ensure any strategy aligns with your specific circumstances.