How Much Should I Spend on a House to Maximize My Tax Benefit?

It’s Not About the Price—It’s About the Mortgage Amount.

This article is dedicated to my good friend, Dr. Spine, a nationally recognized spine surgeon.

Dr. Spine asked me, “Hey Kenny Kim, how much should I spend on a house to maximize my tax benefit? My budget is anywhere from $1 million to $2 million. And I don’t want to get mugged, so I want to live in a decent neighborhood in Pasadena, California.”

This is a common question I receive, so I’m going to break down the key factors to consider when strategizing to maximize the tax benefits of buying a home.

The Key Factor: Mortgage Amount, Not Home Price

The tax benefit isn’t based on the home price—it rather depends on the mortgage amount.

The deduction limit is set by IRC Section 163(h)(3), which governs mortgage interest deductibility.

In 2025, mortgage interest is deductible only on the first $750,000 of mortgage debt for federal tax purposes.

In 2026, this limit reverts to $1 million due to the expiration of the Tax Cuts and Jobs Act (TCJA), which had temporarily reduced the limit to $750,000.

Example: Dr. Spine’s Mortgage Interest Deduction

Let’s assume:

Dr. Spine buys a $1.5 million home with a $500,000 down payment, taking out a $1 million mortgage on January 1, 2025.

His mortgage interest rate is 7%, meaning he will pay $70,000 in mortgage interest in 2025.

2025 Deduction:

Since only the first $750,000 of mortgage debt qualifies for a deduction, only 75% of his mortgage interest ($52,500) is deductible.

2026 Deduction:

Once the limit increases back to $1 million, he can deduct 100% of his $70,000 mortgage interest.

Should He Get a $1M Mortgage Instead of $750K?

Even though Dr. Spine will lose a portion of the deduction in 2025, the limit will increase in 2026. This makes taking a $1 million mortgage a reasonable choice unless he has non-tax reasons for wanting a lower loan amount.

State Considerations: California’s More Generous Rules

Some states, like California, have higher mortgage interest deduction limits than the federal government.

California allows deductions on up to $1 million of mortgage debt, rather than just $750,000.

Since Dr. Spine lives in California, he can fully deduct $70,000 in mortgage interest at the state level, even in 2025.

How Much Does the Mortgage Interest Deduction Lower Dr. Spine’s Tax Bill?

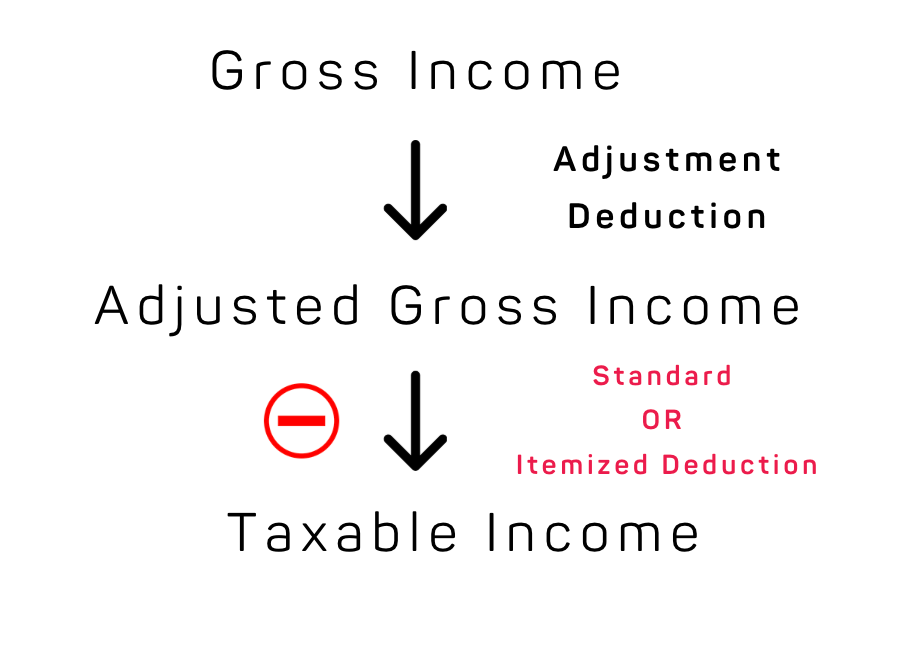

To answer this question, we need to review how the mortgage interest deduction affects his taxable income.

In a previous article, I covered this topic in detail, so be sure to check it out: How An Individual is Taxed!

The key takeaway: The mortgage interest deduction increases itemized deductions, which in turn reduces taxable income.

Standard Deduction vs. Itemized Deduction

Dr. Spine can choose between the standard deduction or itemized deductions—whichever provides the greater tax benefit.

Standard Deduction: A fixed amount based on filing status. For single filers like Dr. Spine, the amount is $15,000 in 2025.

Itemized Deduction: The sum of six deduction categories:

Medical and dental expenses

State and local income taxes (SALT) – Capped at $10,000

Personal interest payments – e.g., Mortgage interest

Charitable contributions – e.g., Donations to a hospital

Casualty and theft losses

Miscellaneous itemized deductions – Mostly suspended until 2026

In general, if you have a large mortgage, itemizing your deductions often provides the greater tax benefit.

Example: Dr. Spine’s Deduction Choices

Standard Deduction: $15,000

Itemized Deduction:

State income tax deduction (SALT): $10,000 (capped, even though he pays over $40,000 in state income tax)

Mortgage interest deduction: $70,000

Total itemized deduction: $80,000

Since $80,000 (itemized deduction) > $15,000 (standard deduction), he will itemize to lower his taxable income.

However, not all of the $70,000 in mortgage interest provides a true tax benefit—because he would have received the $15,000 standard deduction anyway.

Thus, the true additional tax deduction from mortgage interest is $65,000 ($80,000 - $15,000).

Assuming Dr. Spine’s W-2 income is $450,000, his taxable income will be reduced to $370,000 after itemizing deductions.

Quantifying the Tax Benefit of the Mortgage Interest Deduction for Dr. Spine

Federal Tax Savings

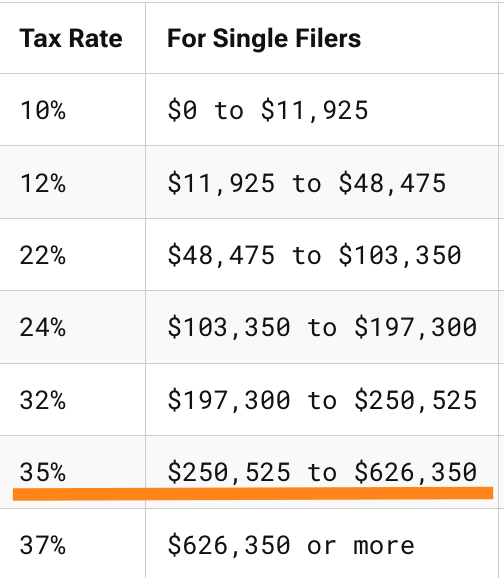

Dr. Spine is in the 35% tax bracket

Tax savings: $65,000 (true additional tax deduction from mortgage interest × 35%) = $22,750

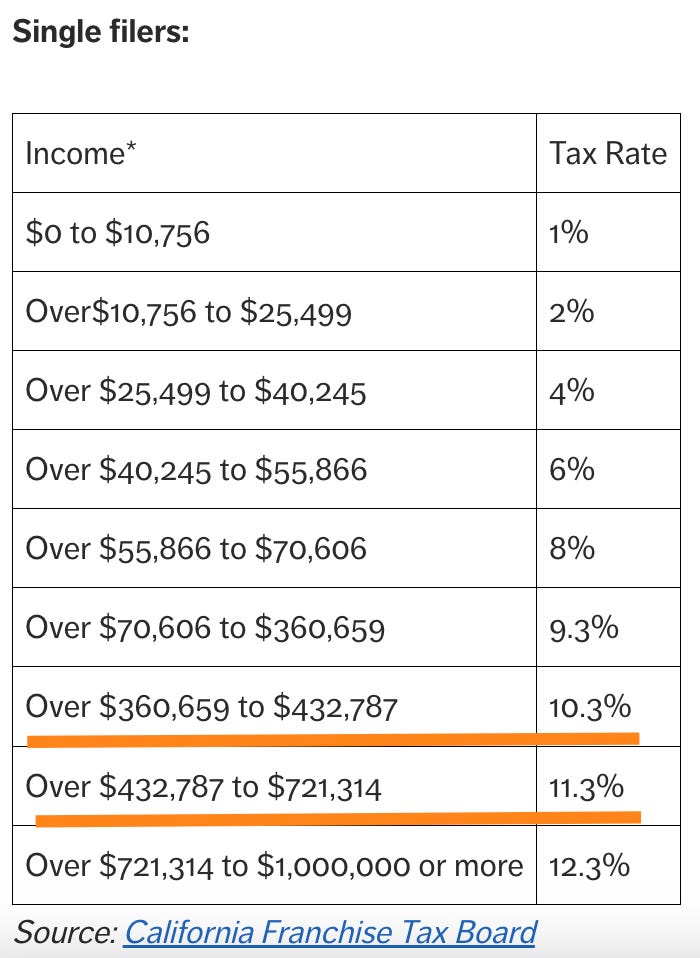

State Tax Savings (California)

Dr. Spine is in the 11.3% tax bracket (though part of the deduction is in the 10.3% bracket).

Tax savings: $65,000 x (a mix of 11.3% + 10.3%) = ~$7,000

Total Tax Savings: ~$30,000

Federal: $22,750

State: ~$7,000

Effective Mortgage Rate After Tax Savings

Even though Dr. Spine is paying $70,000 in mortgage interest annually, his true after-tax cost is lower due to tax savings:

Actual cost of mortgage interest after tax benefit:

$70,000 (interest paid) - $30,000 (tax benefit) = $40,000

After-tax effective mortgage interest rate

$40,000 ÷ $1,000,000 = 4%

Thus, while the stated mortgage rate is 7%, the true cost after tax benefits is effectively 4%.

Final Thoughts

For maximum tax benefits, Dr. Spine should consider taking out a $1 million mortgage rather than a smaller loan.

Even at a 7% interest rate, his true cost is closer to 4% after factoring in tax savings.

In 2026, he can deduct 100% of his mortgage interest at both the federal and state levels when the federal level mortgage deduction limit will increase back to $1 million.

Of course, tax benefits shouldn’t be the only factor when buying a home. If cash flow, risk tolerance, or financial goals suggest a lower mortgage is better, that should take priority.

But if the goal is to maximize tax deductions, a $1 million mortgage in California makes sense from a tax standpoint.

Disclaimer 1: click here