How a Power Physician Couple Maximized Their 401(k) Contributions and Saved Over $130,000 in Taxes

Yes, You Can Too!

Recently, I met a high-earning baller physician couple - one is a dermatologist, and the other is an orthopedic surgeon - who together earn approximately $1.6 million annually.

This means that every dollar of taxable income above $730,000 is taxed at the highest federal marginal tax rate of 37%. Since they reside in California, factoring in state income taxes and Medicare taxes, their marginal tax rate exceeded 53%.

Ouch.

The Advantage of Multiple Income Sources

From a tax planning perspective, the good news was that:

They each had W-2 income of approximately $400,000 from their large medical group employers.

They also had pass-through income of approximately $400,000 each as 25% shareholders of S corporations (one from a smaller orthopedic practice and the other from a dermatology practice).

This meant they could have four separate 401(k) plans, since each entity can support its own 401(k) plan. Since their primary tax goal was to defer as much income as possible to reduce their tax liability now, we decided to implement the simplest and very effective strategy: maximizing their 401(k) contributions.

401(k) Maximization Strategy

401(k) Contribution Limits

Under IRC §415(c), the total maximum contribution per 401(k) plan is $69,000 for the 2024 tax year and is $70,000 for the 2025 tax year.

If you are 50 or older, an additional $7,500 catch-up contribution is allowed, bringing the total to:

$76,500 in 2024

$77,500 in 2025

How Many 401(k) Plans Can You Have?

You can have multiple 401(k) plans, but each business can only sponsor one 401(k) plan per taxpayer. Generally, if you work a W-2 job and also own a separate business, you can have two 401(k) plans - one from your employer and one from your business.

If you own multiple businesses, the 80% ownership rule applies. Businesses you own more than 80% of are treated as one entity for determining the 401(k) contribution limits.

For example, if you wholly own two businesses, your combined 401(k) contribution limit remains $70,000 in 2025 ($77,500 if 50 or older), even though each business can sponsor its own 401k plan.

401(k) Contribution Components

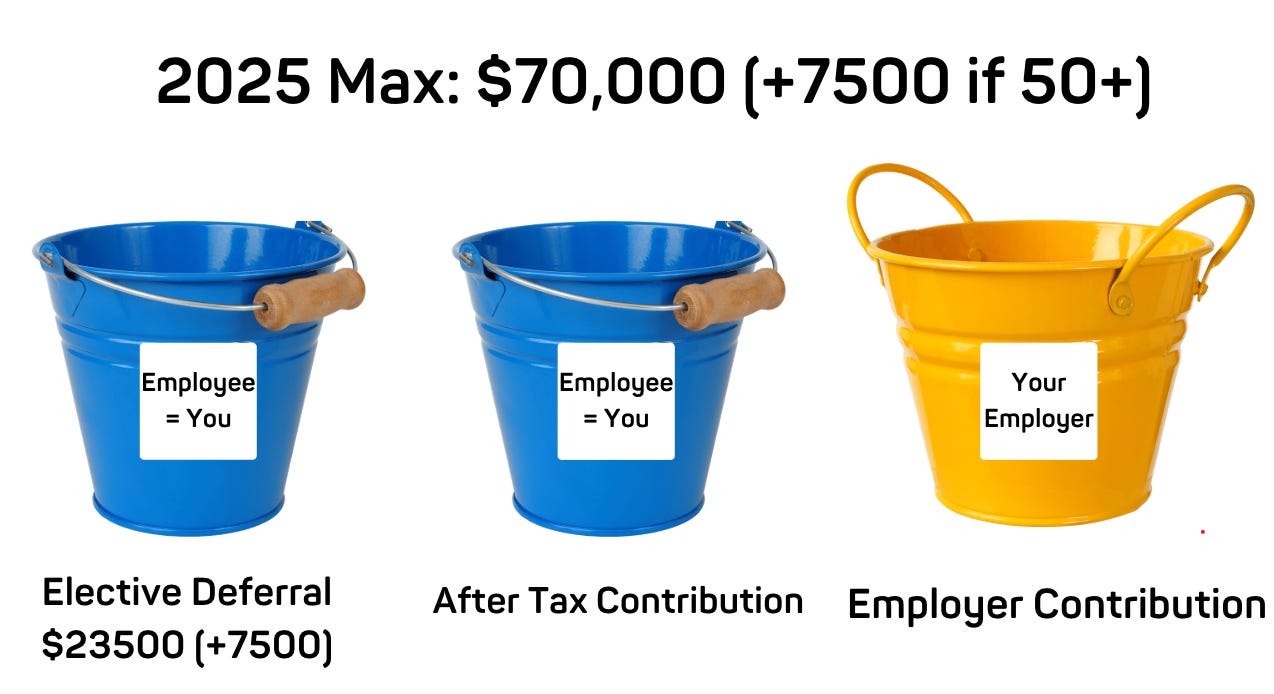

Each 401(k) plan consists of three contribution components (buckets):

Elective Deferral: This bucket is filled with the employee’s pre-tax contributions, which are capped at $23,500 in 2025. By contributing to this bucket, your taxable income is ultimately reduced by the elective deferral amount for income tax purposes, allowing you to defer taxes on that portion of your earnings until withdrawal in retirement.

Employee After-Tax Contribution: This bucket is filled with after-tax contributions made by the employee, which can later be converted to Roth (via in-plan conversion). Not all 401(k) plans offer this option.

Employer Contribution: Your employer can contribute to this bucket on a matching or non-matching basis. The maximum employer contribution is 25% of your salary, subject to the §415(c) limit ($70,000 in 2025).

How This Couple Maximized Their Contributions

Their Employment and 401(k) Setup

Both worked for a large medical group (W-2 employment) and participated in their employer-sponsored 401(k) plans. Both were 25% shareholders of an S corporation (one dermatology practice and one orthopedic practice) and had a solo 401(k) through their S corporations. Since each employer can have its own 401(k), each physician had two 401(k) plans (one traditional and one solo 401(k), totaling four 401(k) plans between them.

Step-by-Step Contribution Strategy

For the Dermatologist (Husband)

1. W-2 Employer-Sponsored 401(k)

Elective Deferral: He contributed the maximum $23,000 (in 2024).

Employer Contribution: His employer contributed $46,000.

One important note is that the maximum employer contribution is based on 25% of the employee’s salary, which typically limits how much the employer can contribute to this bucket. Since his W-2 salary was $400,000, the maximum possible employer contribution (25% of salary) was $100,000. Because $46,000 is less than $100,000, the employer was able to contribute the entire $46,000, ensuring that the combined total of elective deferral and employer contribution did not exceed the $69,000 limit for 2024.

2. Solo 401(k) via S Corporation

No elective deferral was allowed since it was already used in the W-2 plan.

Employer Contribution: Contributed $69,000.

Again, there was no issue here because his S corporation salary was $400,000, and the maximum employer contribution allowed was 25% of salary ($100,000). Since $69,000 is less than $100,000, he was able to contribute the full $69,000, staying within the IRS limit for 2024.

For the Orthopedic Surgeon (Wife)

She followed the exact same strategy as her husband.

1. W-2 Employer-Sponsored 401(k)

Elective Deferral: $23,000.

Employer Contribution: $46,000, which was less than the 25% salary cap, since her salary was also $400,000.

2. Solo 401(k) via S Corporation

Employer Contribution: $69,000 (subject to the same 25% salary rule, with her S corporation salary at $400,000).

Total Contributions and Tax Savings in 2024

For the dermatologist: $69,000 to his W-2 401(k) and $69,000 to his solo 401(k), totaling $138,000.

For the orthopedic surgeon: $69,000 to her W-2 401(k) and $69,000 to her solo 401(k), totaling $138,000.

For the couple: $276,000 total contributed to their 401(k) plans

By implementing this strategy, they set aside $276,000 annually into tax-deferred retirement accounts, effectively deferring tax on this income at rates nearing 50%. Instead of paying $130,000+ in income taxes, they redirected those funds into their retirement accounts for tax-deferred growth.

Key Takeaways

Dual and high-income physicians with W-2 jobs and pass-through income can achieve massive tax deferral by maximizing 401(k) contributions, leveraging both an employer-sponsored 401(k) and a solo 401(k).

Elective deferrals are capped per person, not per plan, so allocation must be carefully planned.

Employers can contribute up to 25% of W-2 wages for a solo 401(k), but total contributions are subject to the $70,000 limit in 2025 ($77,500 if 50 or older).

Disclaimers: click here