Haven’t Filed an Extension Yet?

Follow These 5 Super Easy Steps to Do It Yourself and Avoid the Failure-to-File Penalty!

Taxes are due today!

If you are not ready to file your tax return today, the best thing you can do is file an extension.

If you don’t file an extension and end up submitting your return even one day late, the IRS will hit you with a 5% penalty on any unpaid taxes—that’s the Failure-to-File penalty.

So, if you’re rushing to get your extension in, just follow this 5-step process.

Super easy!

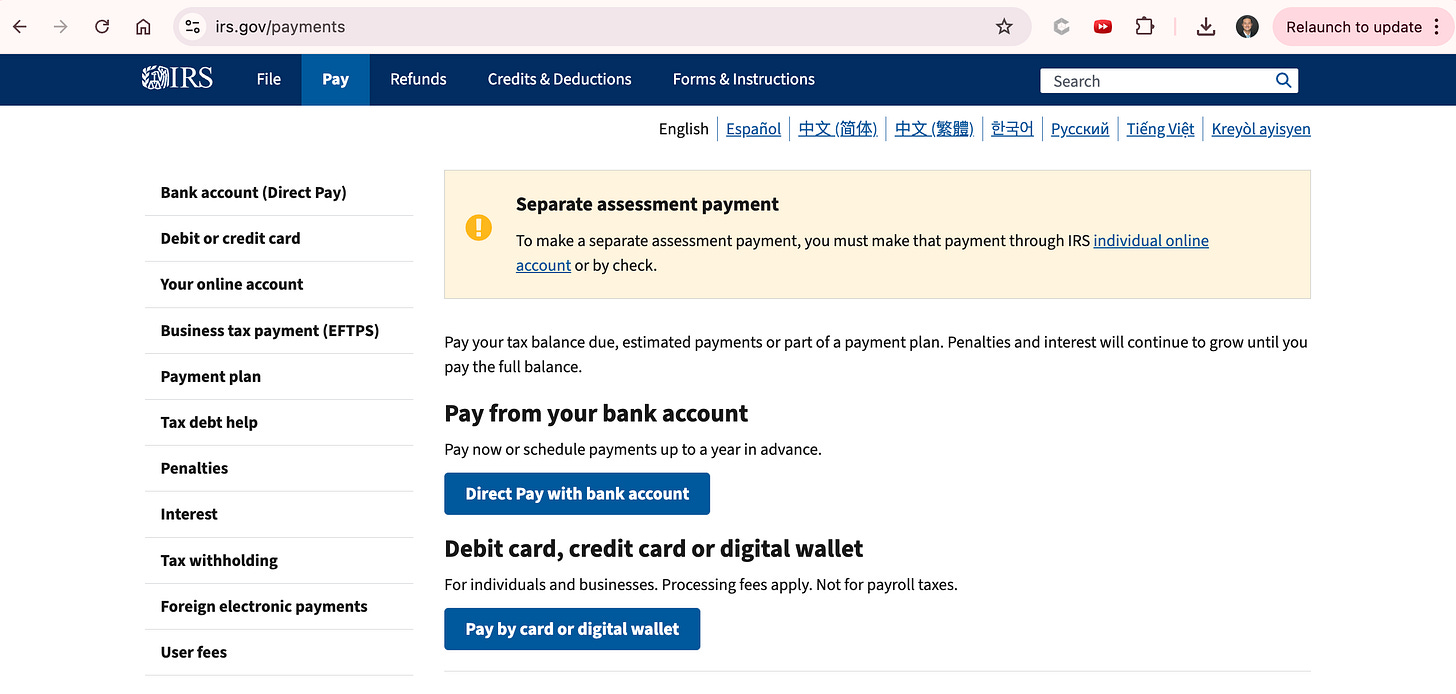

Step 1: Go to irs.gov/payments and Click “Direct Pay with bank account”

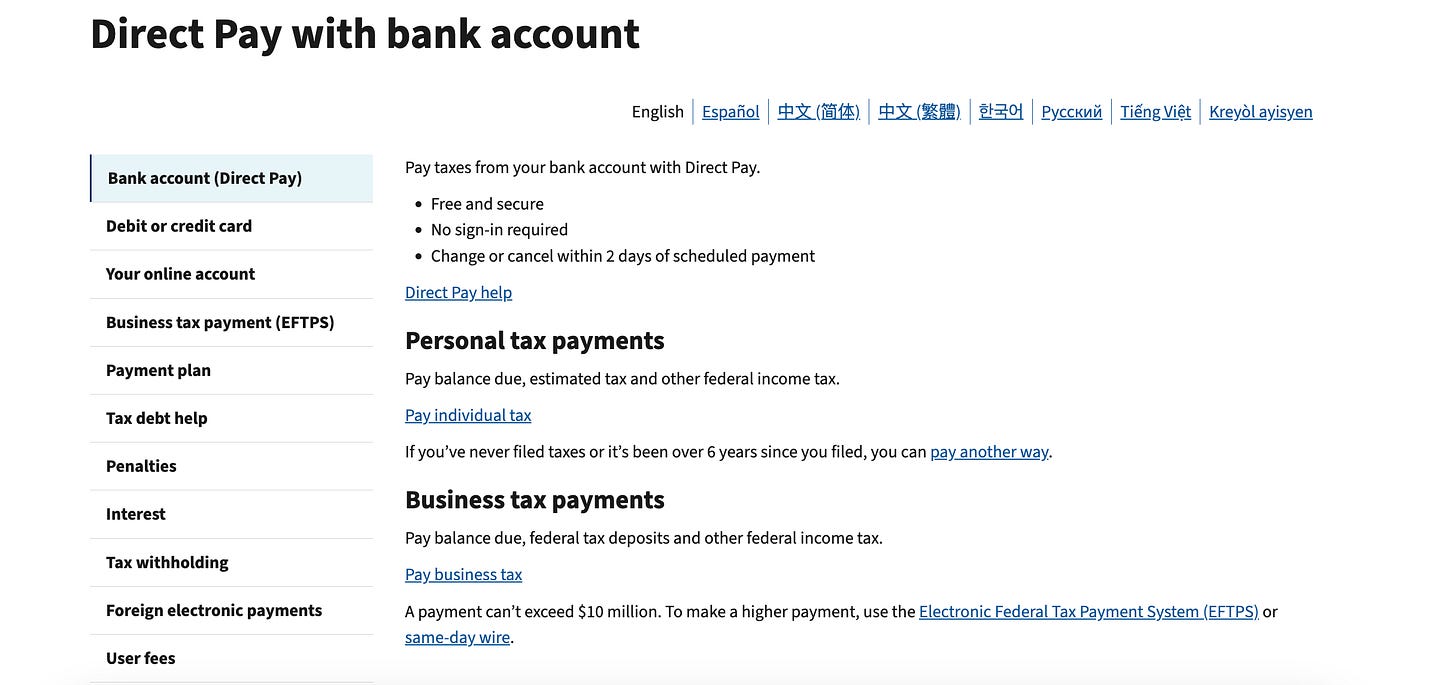

Step 2: Click “Pay individual tax”

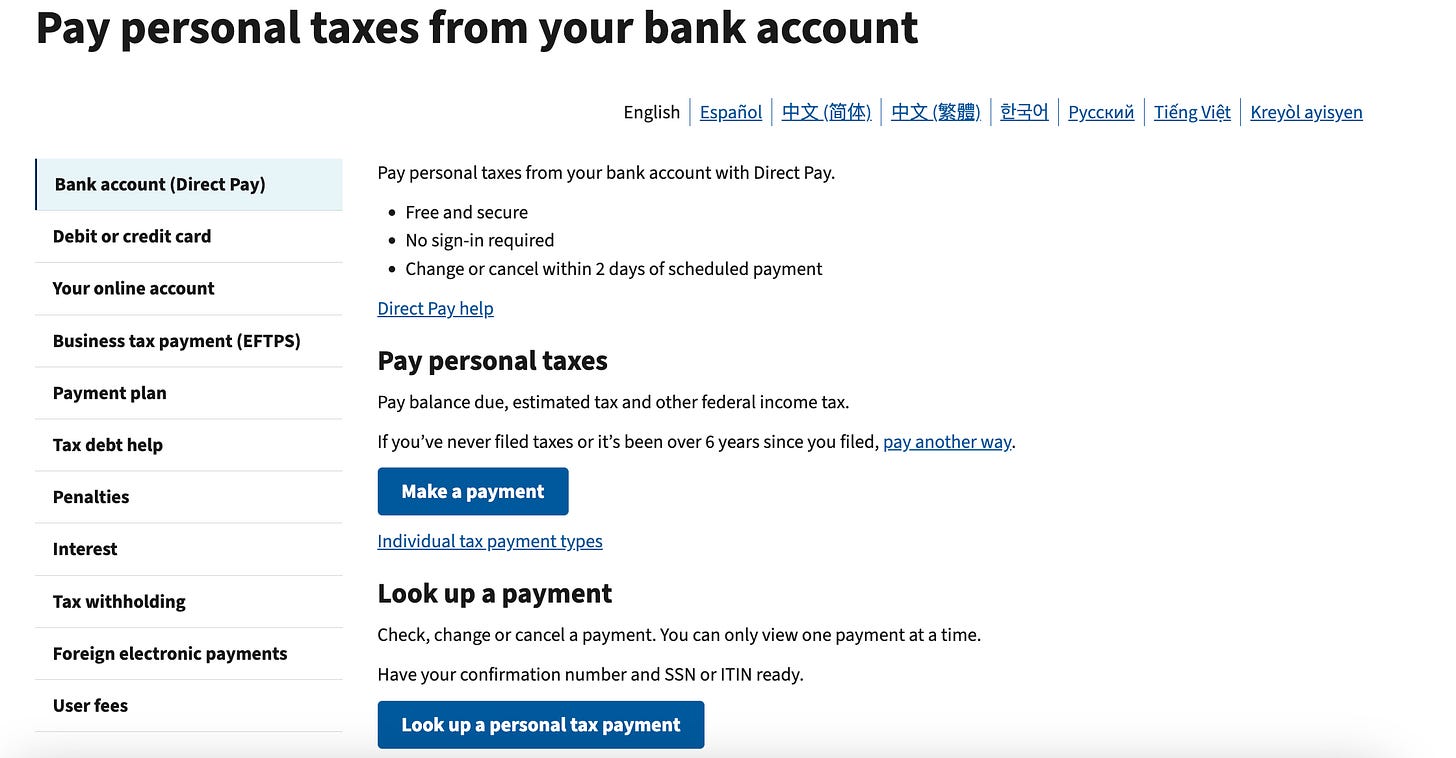

Step 3: Click “Make a payment”

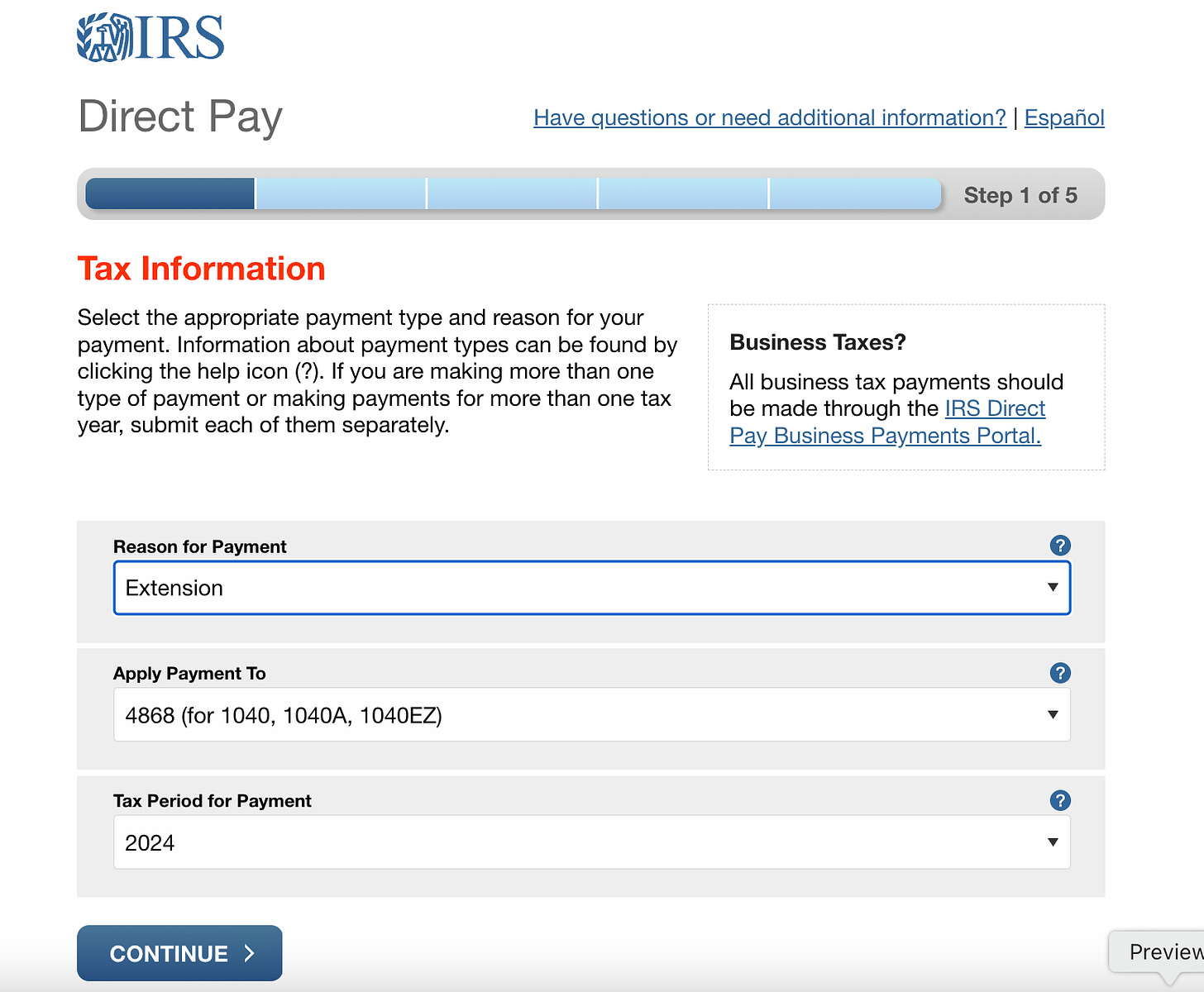

Step 4: For “Reason for Payment”, select “Extension”. For “Apply Payment To”, select “4868 (for 1040, 1040A, 1040EZ)”

Step 5: Enter the amount you think you’ll owe for your 2024 tax return and complete the payment process.

If you don’t know what you’ll owe, add up all the taxes you already paid in 2024 via estimated payments and payroll withholding. Make sure your total tax paid is at least 90% of your 2024 total tax liability to avoid the estimated tax penalty.

Make sure that you pay something with your extension!

Disclaimer: click here