Got Money Overseas?

How to Avoid the Scariest IRS & FinCEN Penalties Most Doctors Don’t Know Exist

Meet Dr. Sandu.

He is a hotshot cardiologist in Los Angeles.

In 2024, he ha a week-long wedding celebration in India.

It was big. Like, $200,000 big.

He told me he transferred $250,000 to the State Bank of India to pay for his wedding. When I heard that, my tax-pro antenna went up.

I asked, in an inquisitive voice,

“You know… that you have to report your foreign bank account to the IRS, right?”

He looked at me like a deer caught headlights.

“What you talking about, Kenny Kim?”

I was’t surprised by his confused reaction - because most people have no ideal these rules even exist. Which is wild is that the penalties for noncompliance can be brutal - tens of thousands of dollars!

But I was excited - because I knew I could help him avoid at least $20,000 in penalties just by walking him through what to do next.

Here’s the Deal:

There is a set of little-known (and frankly scary) foreign reporting rules that can slap U.S taxpayers - like Dr. Sandu - with hefty fines if they fail to disclose foreign financial assets.

Wanna guess the minimum penalty?

$10k per violation!

In serious cases, the fines can reach six figures!

So in this article, I’ll break down,

What triggers the reporting requirement

What forms to fill out

And when to file them

So people like Dr. Sandu (maybe even you?) can stay on the IRS’s good side.

What To Know

When it comes to foreign assets disclosures, there are two separate reporting rules U.S taxpayers must know and follow.

FATCA (Foreign Account Tax Compliance Act) – found in the internal revenue code and enforced by the IRS.

FBAR (Foreign Bank Account Report) – enforced by the Financial Crimes Enforcement Network (FinCEN). Yes, that’s the IRS’s tougher sibling. And yes, its name includes the words “Crimes Enforcement.” Comforting, right?

Let’s tackle these one at a time.

#1: FATCA - Foreign Account Tax Compliance Act

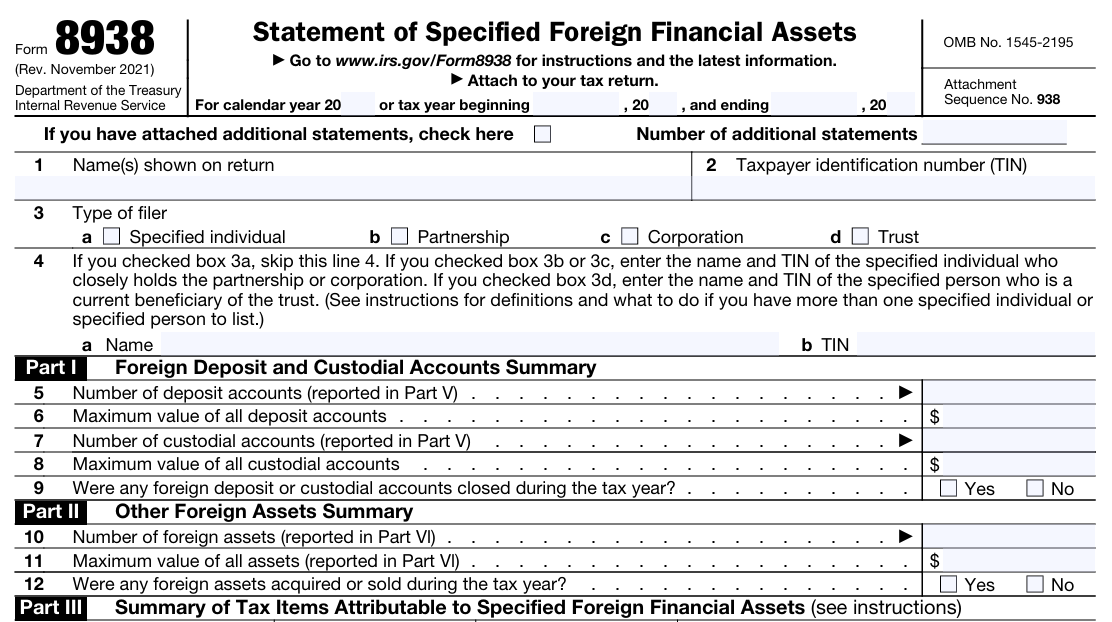

Under FATCA, all U.S. taxpayer - including citizens and residents like Dr. Sandu - must file Form 8938 with their tax return if they hold foreign financial assets over certain thresholds.

Remeber: Dr. Sandu transferred $250,000 to the State Bank of India. That’s deep in the FATCA territory.

What Counts as Foreign Financial Asset?

Foreign bank accounts (e.g., Dr. Sandu’s State Bank of India)

Foreign brokerage or investment accounts (e.g., holding hold Tata motors stock in India’s National Stock Exchange)

Filing Thresholds (for taxpayers living in the U.S)

Single or Married Filing Separately:

More than $50,000 at year-end, or

More than $75,000 at any time during the year

Married filing jointly:

More than $100,000 at year-end, or

More than $150,000 at any time during the year

Since Dr. Sandu had $250,000 in his indian bank account before his wedding expenses, he clearly met the FATCA threshold - whether he filed single or jointly.

That means:

He must file Form 8938 with his tax return (Form 1040)

It is due by Tax Day (April 15) or with an extension (October 15, 2025)

Note: the filing thresholds are 4x higher for taxpayers living abroad.

What Are the Penalties?

They are steep!

$10,000 for failure to file per year.

Up to $50,000 if Dr. Sandu ignores IRS notices (he will get hit with an extra $10,000 for every 30 days late)

40% penalty on unreported income tied to undisclosed foreign assets. This means, the IRS will essentially take all unreported income with 40% penalty and regular tax on the income!

Oh- and criminal charges for willful evasion.

Thanks to FATCA, many foreign banks report U.S accounts directly to the IRS. So flying under the radar? not a great plan.

FATCA For Dr. Sandu:

Dr. Sandu’s $250k transfer absolutely triggered the FATCA reporting requirements. Let’s hope he files Form 8938 timely this year and avoid some very expensive consequences

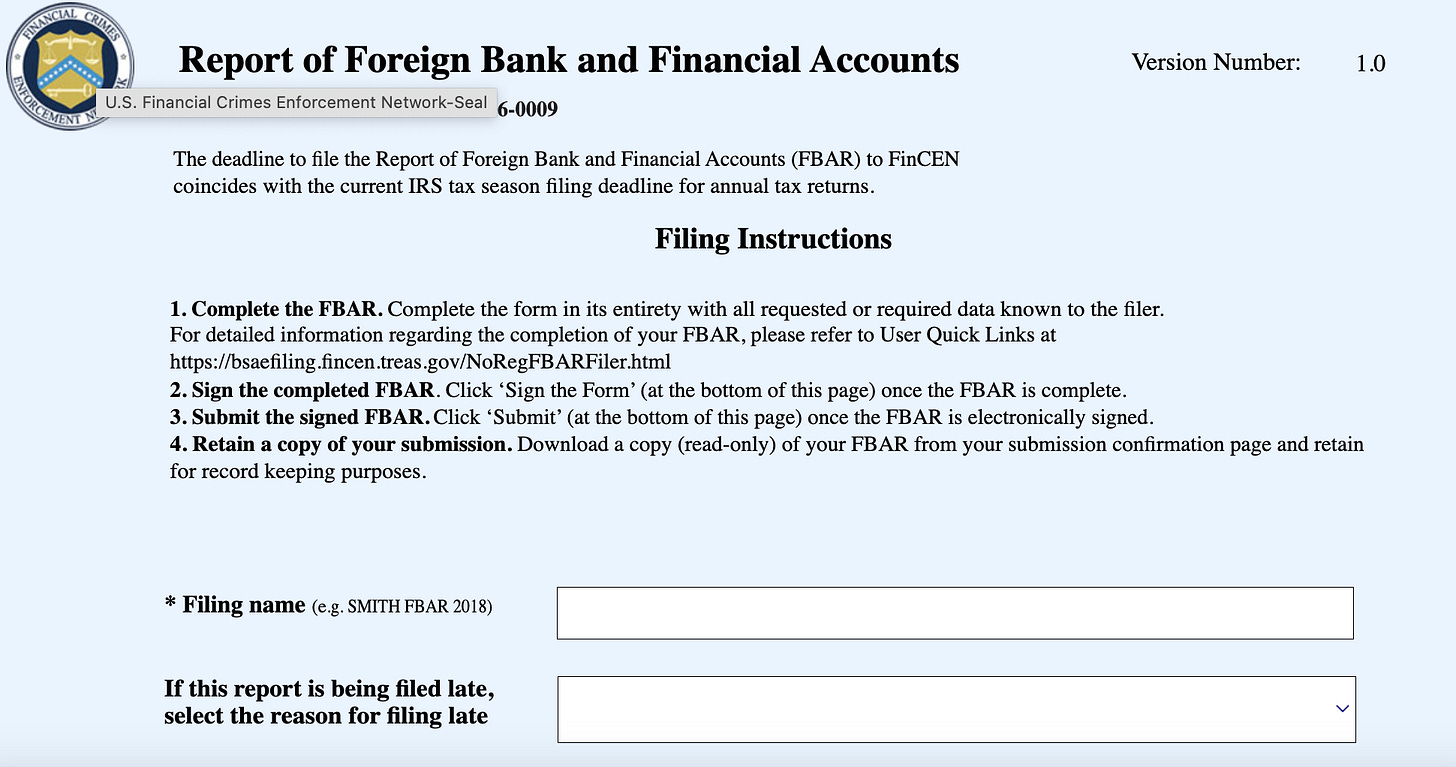

#2. FBAR - Foreign Bank and Financial Accounts Reporting

Separate from FATCA, there is another rule that kicks in when a U.S person (citizen or resident) has foreign financial accounts with a combined value over $10,000 at any point during the year.

If that applies, they must fileFinCEN Form 114, commonly known as the FBAR, electronically with FinCEN, not the IRS.

Does This Apply to Dr. Sandu?

Yes. With $250,000 in his Indian bank account, he easily meets the FBAR threshold.

What Counts Towards the $10,000?

Foreign checking, savings, brokerage accounts

Certain foreign retirement accounts

Any account where you have signature authority - even if you don’t own the funds. If Dr. Sandu’s parents gave him power to move funds in their State Bank of India account (signature authority), that alone could trigger the FBAR filing requirement, even if Dr. Sandu’s own zero balance in his State Bank of India.

It is important to remember that it is the combined value of all foreign accounts that that matter, not each one individually. If the total went over $10,000 at any moment during the year, even for one day, you would have to file.

When to File Form 114?

File online through FinCEN’s website, not with the IRS.

Due Tax Day (April 15), with an automatic extension to October 15, 2025

What Are the Penalties?

They are no joke:

For non-willful violation (i.e., “opps, I didn’t know”), the maximum penalty can be $16,536 per year (2025)

For willful violation (i.e., "I knew but didn’t file), the maximum penalty is the greater of

$165,350 OR

50% of the account balance - assessed per account, per year

So, if Dr. Sandu had $100,000 in the State Bank of India and knowingly skipped the FBAR? The government could essentially wipe out his entire bank account with penalties!

Oh - and criminal charges may also apply for willful noncompliance.

Double Trouble: FATCA + FBAR

If Dr. Sandu failed to file both Form 8938 and Form 114, he can be hit with separate penalties for each.

That’s a double whammy.

And unfortunately, the classic “Opps, I didn’t know” usually doesn’t fly with the IRS or FinCEN.

Final Thoughts

If you’ve got a substantial amount of money overseas, don’t play hide-and-seek with the IRS or FinCEN. The rules might be a headache, but the consequences of noncompliance can be a full-blown migraine and possibly financial ruin.

Filing an FBAR and Form 8938 is a much easier and cheaper remedy than dealing with five- or six-figure penalties.

So, take the time to review the FATCA and FBAR filing requirements.

They depend on:

How much you hold foreign financial assets

Whether you live in the U.S or abroad

Your filing status (single, married, etc)

If you fail to file both forms when required, you could easily be looking at $20,000+ in penalties per year.

An ounce of paperwork prevention is worth many pounds of cure - and in this case, worth avoiding tends of thousands in fines

Stay complaint - and you will never have to fine out just how scary the IRS and its scarier sibling, FinCEN, can be.

Disclaimer: click here