Dual-Income Household? Be aware of the Nanny Tax!

Tips to Avoid Compliance Hassles and Save Money!

Many of my physician colleagues are in households with two working spouses.

That means someone has to take care of the kids.

Nanny!

Whether your nanny is your mom, mother-in-law, or a hired professional, if you are paying for childcare, you need to be aware of the unintended and often overlooked tax consequences.

It’s called the nanny tax!

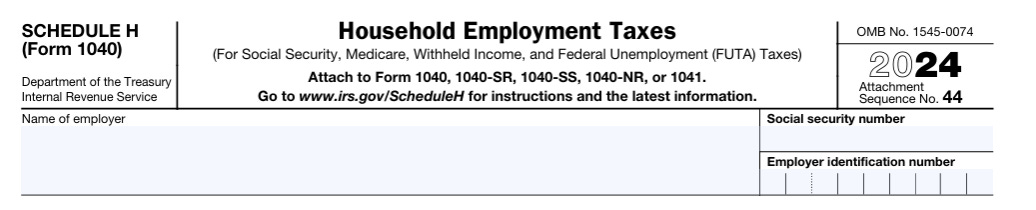

If you pay your nanny more than $2,800 per year or $1,000 per quarter (for 2025), you are required to file Schedule H with your tax return and pay additional taxes.

What taxes are involved?

1. Payroll tax (FICA): 7.65% of the nanny’s salary (for Social Security and Medicare).

2. Unemployment tax (FUTA): Up to 6% on the first $7,000 of wages paid.

3. Federal income tax withholding: You may be required to withhold federal income tax.

Here’s an example of additional federal taxes you may have to pay:

If you pay your nanny $7,000 per year, your tax obligations might include:

• FICA tax (7.65%): $535

• FUTA tax (6% of the first $7,000): $420 (you can receive a credit of up to 5.4% for state unemployment taxes paid, reducing the effective FUTA tax rate to 0.6%, which equals $42).

• Total nanny tax liability: $577 (assuming the credit applies).

To make matters even worse, some states—like California, a tax-hungry hippo—have stricter rules.

In California, the nanny tax applies if you pay more than $750 per quarter, rather than the federal threshold of $1,000. That means you gotta pay State Disability Insurance (SDI) to the California Employment Development Department (EDD).

If you pay more than $1,000 in a calendar quarter, you are also required to pay Unemployment Insurance (UI) and Employment Training Tax (ETT).

OMG!

What can you do?

Consider the following strategies:

1. Verify the nanny tax threshold applicable in your state and at the federal level.

2. Strategically structure nanny payments to stay below the threshold when possible.

Even though the tax itself may not seem significant in dollar terms, the administrative burden and paperwork associated with filing (e.g., issuing a Form W-2) and compliance can be overwhelming—especially when you and your spouse are already juggling busy work schedules.

References: Internal Revenue Code §3401, IRS Publication 926.

Disclaimer

One of my heroes, Mel Herbert, MD, founder of EM-RAP, may have once said:

“Don’t just do something, stand there.”

That would be my advice to you after reading my blog—stand there (for now) and don’t do anything (yet).

Why?

While I am a tax professional, I am not your tax professional. I do not know your particular situation, and tax matters can be complex. What works for one person may not work for another.

Before taking action, assess your situation and consult with your tax professional to ensure any strategy aligns with your specific circumstances.