Dr. Nip-Tuck’s Huracán Hustle: Can He Really Write Off a $500K Lambo?

Meet the depreciation devil - Section 280F - that crushed his dream of expensing his supercar.

In the previous article, I introduced Dr. Nip-Tuck — a hot-shot plastic surgeon from L.A. with a love for Lamborghinis. We reviewed which of his four Lambos are eligible for depreciation.

Now, let’s turn our attention to the winner: his Lamborghini Huracán, which he uses exclusively for his Turo rental business. As a result, it is eligible for depreciation.

The question I will answer in this article is:

• When, and How much can he write off?

When Does Depreciation Start?

Depreciation starts when the asset is placed in service — meaning it is ready and available for its intended business use.

In Dr. Nip-Tuck’s case, that’s when:

The Huracán is purchased,

Registered and insured for commercial use, and

Listed on Turo, ready for rental.

The key point: it does not need to be rented for the depreciation to start. As long as the vehicle is functionally and aesthetically ready for rent, the depreciation clock starts. Even if no one rents the Huracán for a month on Turo, it is still eligible for depreciation while sitting in the garage, as long as it is ready and available for rent.

Dr. Nip-Tuck should document the date his Huracán becomes “ready and available” to support start date in case of an audit.

How Much Can the Huracán Be Depreciated?

Let’s assume:

The Huracán was purchased new for $500,000 (including tax and fees),

It is used 100% for Dr. Nip-Tuck’s rental business,

It was placed in service on January 1, 2025.

There are three major depreciation methods we’ll evaluate:

MACRS (Modified Accelerated Cost Recovery System) Depreciation

Section 179 Deduction

Bonus Depreciation

The Basic Depreciation Tax Rules for Cars: MACRS

Under standard tax rules, passenger vehicles like the Huracán are depreciated using the MACRS as 5-year property. This means, the $500,000 Dr. Nip-Tuck spent on the car would be recovered through depreciation over five years, with more depreciation in the earlier years and less in the later years.

Assuming the Huracán is placed in service on January 1, 2025, the depreciation schedule under MACRS would look approximately like this:

Year 1: 20% → $100,000

Year 2: 32% → $160,000

Year 3: 19.2% → $96,000

Year 4: 11.52% → $57,600

Year 5: 11.52% → $57,600

Year 6: 5.76% → $28,800

Even though MACRS is called a "5-year schedule," it actually spreads deductions over six tax years due to the half-year convention, which assumes the asset is placed in service at mid year(e.g., July 1, 2025).

But Dr. Nip-Tuck is not so lucky - he has to deal with a little depreciation monster, called IRC §280F.

Meet the Monster: IRC §280F — The Luxury Auto Depreciation Limits

IRC §280F is the monster when it comes to writing off most business vehicles. This little depreciation devil, known as the luxury auto depreciation limit, severely restricts how much of a vehicle’s cost can be depreciated over its tax life (typically five years).

What is wild is that, despite of being called the “luxury car” limitation, §280F applies to nearly all regular cars that weigh 6,000 lbs or less, not just Lambos and Bentleys.

The Huracan, which weighs around 3,400 lbs is definitely subject to these limits.

What Are the Limits?

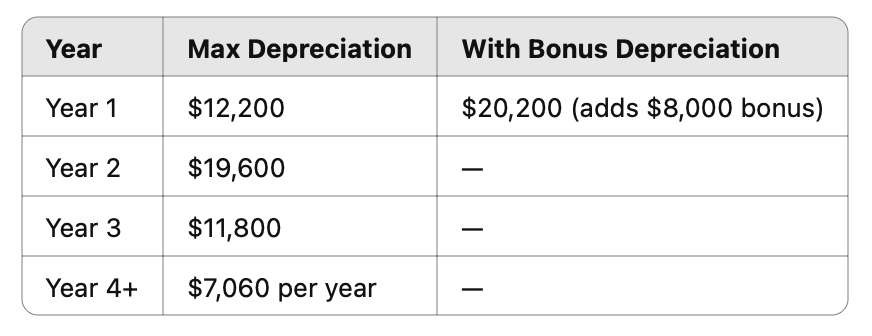

Here’s a table of the maximum depreciation Dr. Nip-Tuck can claim under §280F for his Huracán, placed in service on January 1, 2025, assuming 100% business use:

The total allowable depreciation over six years, including bonus depreciation, is only $72,780.

That means, even after six years, Dr. Nip-Tuck still has $427,220 of undepreciated basis left. At $7,060 per year, it could take him more than 60 years to fully depreciate the car.

By then, his Huracán will probably be in a museum… or the junkyard.

What About Section 179?

Section 179 allows for the full deduction on the cost of eligible business property (up to $1.25M in 2025) — but here’s the catch:

Passenger vehicles under 6,000 lbs are still limited by §280F.

Even if the Huracan qualifies under Section 179, the maximum depreciation deduction is still governed by the devil himself, §280F, which capped Year 1 depreciation at $12,200 (or $20,200 with bonus depreciation).

If the Huracán weighted more than 6000lb, §280F would not apply, and Dr. Nip-Tuck could potentially benefit from Section 179 expensing. However, even then, Section 179 has its own vehicle limitations based on the type of the vehicle. Unless the vehicle fits into one of the following three exceptions, the maximum 179 deduction is $31,300 in 2025.

To fully escape the Section 179 vehicle limit, the vehicle must be one of the following:

Seats more than 9 passengers behind the driver (e.g., Ford Transit),

Has a cargo area of at least 6 feet (e.g., Chevy Silverado 3500),

Has No seating behind the driver (e.g., Mercedes Sprinter delivery vans).

In short, since the Huracán weights less 6000lb, its depreciation is still limited by §280F. That means, Dr. Nip-Tuck is capped at $20,200 in Year 1 (with bonus depreciation), and Section 179 won’t help him.

What About Bonus Depreciation?

Bonus depreciation under §168(k) lets businesses deduct a portion of a qualifying asset’s cost in the first year it is placed in service.

In 2025, the bonus depreciation rate is 40%.

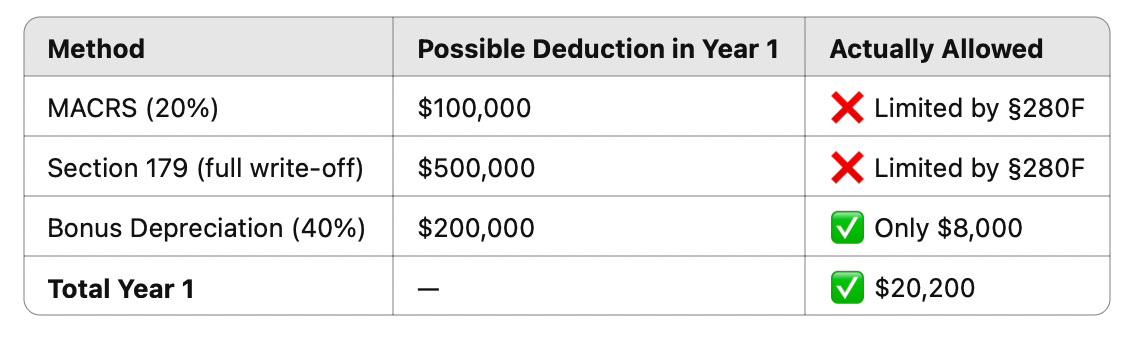

In theory, 40% of $500,000 - or $200,000 - would be the bonus deduction Dr. Nip-Tuck could claim for his Huracán.

But once again, the devil §280F steps in.

The bonus depreciation is capped at only $8,000 in Year 1 under §280F.

The remaining unused bonus depreciation - $192,000 - is not deferred. It’s lost. Gone forever.

So What’s the Bottom Line?

Dr. Nip-Tuck is completely hamstrung by §280F.

Here’s a quick summary:

Even though Dr. Nip-Tuck uses the Huracán 100% for business,

Even though it qualifies for MACRS, Section 179, and bonus depreciation,

He’s still limited to just $20,200 in Year 1 — and the rest of the depreciation drips out slowly over decades.

Much of the bonus depreciation is lost forever, thanks to §280F.

Fun fact: This is one of the main reasons why the Mercedes G-Wagon is so popular among high-income earners like Dr. Nip-Tuck. Since it weighs over 6,000 pounds, it’s not subject to §280F — making it fully eligible for Section 179 expensing and bonus depreciation.

Final Thoughts

Remember: Depreciation begins when the Huracán is ready and available for rent — not when it is first rented.

Due to the devil §280F, luxury cars like the Huracan face tiny depreciation caps, no matter how much they cost. Section 179 and bonus depreciation won’t help unless the vehicle weighs more than 6,000 lbs.

If you’re buying a business vehicle, check the weight — it can make or break your tax write-off.

For Dr. Nip-Tuck, the Huracan might be a great ride — but from a tax perspective? Not so much.

Disclaimer: click here