Burned Out? Taking a Sabbatical?

Part 2/2 – Use This Tax Strategy to Maximize Tax-Free Wealth Building!

Yesterday, I shared a strategy on how James could leverage the magical 0% capital gains tax rate to fund his sabbatical year tax-free.

But what if James’ situation were a bit different?

What if he didn’t have any appreciated assets to sell but instead had a significant amount of pre-tax money in his IRA or 401(k)?

During his sabbatical year, he could convert his pre-tax IRA or pre-tax 401(k) into a Roth IRA or Roth 401(k) while recognizing income at a much lower tax bracket.

Let’s break down how much money he could save by converting his IRA/401(k) to a Roth during his sabbatical year.

A Brief Overview of IRA, 401(k), and Roth Accounts

Retirement accounts such as IRAs and 401(k)s can be funded with either pre-tax or post-tax money.

Pre-Tax Contributions (Traditional IRA/401(k))

When you contribute to a pre-tax retirement account, such as a Traditional 401(k) or SEP-IRA, you receive a tax deduction for that year.

For example, if you contribute $30,000 to a 401(k) or SEP-IRA, your taxable income is reduced by $30,000.

The funds then grow tax-deferred, meaning you won’t pay taxes on investment earnings until you withdraw the money in retirement, at which point it will be taxed as ordinary income.

Post-Tax Contributions (Roth IRA/401(k))

When you contribute to a post-tax retirement account, such as a Roth IRA or Roth 401(k), you contribute money that has already been taxed.

The key benefit?

Both the contributions and investment growth are tax-free upon withdrawal—as long as you meet qualifying conditions (e.g., reaching retirement age or facing certain exceptional circumstances like disability).

Which Contribution Type Makes Sense?

When your tax rate is high (e.g., during peak earning years), pre-tax contributions may be more advantageous since they lower your taxable income now.

When your tax rate is low (e.g., during a sabbatical year), funding a Roth account with after-tax money might be more beneficial, as withdrawals in retirement will be tax-free.

Roth Conversions: Moving Pre-Tax to Post-Tax

You may have the option to convert pre-tax money to post-tax money at any time, known as a Roth conversion. However, the amount you convert is treated as taxable income in the year of conversion.

Let’s assume James has $126,950 in his SEP-IRA (pre-tax) and wants to convert all of it to Roth.

This means James will recognize an additional $126,950 in taxable income for that year.

Timing Matters: When James Converts Determines His Tax Bill

Scenario 1: Roth Conversion During Sabbatical Year

Let’s assume the following:

James has no other income during his sabbatical year.

He and his spouse live in California and take the $30,000 federal standard deduction and the $11,080 California standard deduction.

Step 1: Federal Tax Calculation

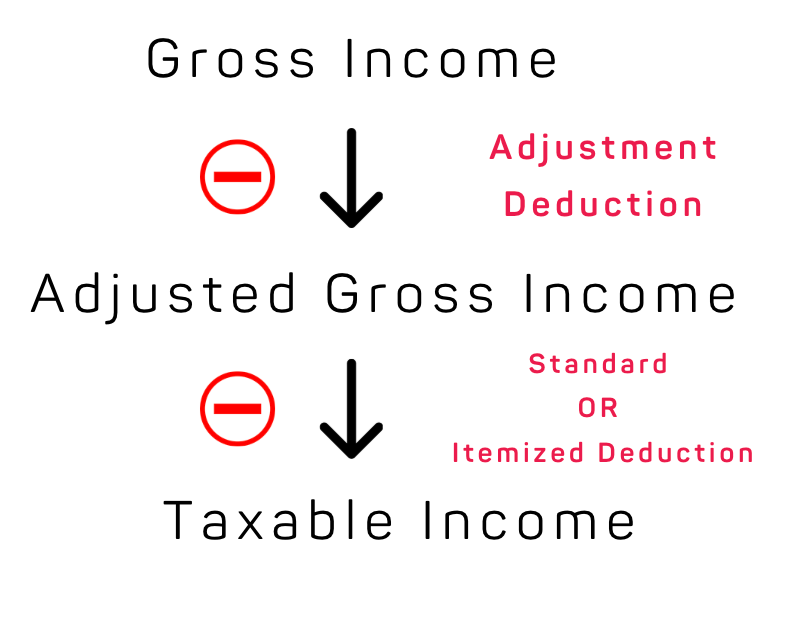

James’ taxable income for federal tax purposes:

$126,950 (Gross Income) – $30,000 (Standard Deduction) = $96,950 (Taxable Income)

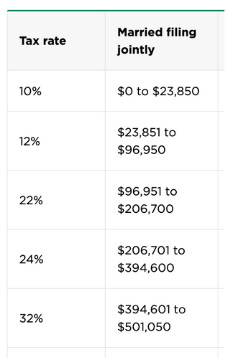

Applying the federal tax brackets:

First $23,850 taxed at 10% → $2,385

Remaining $73,099 taxed at 12% → $8,772

Total Federal Tax: $11,157

Step 2: California Tax Calculation

James’ taxable income for California:

$126,950 (Gross Income) – $11,080 (Standard Deduction) = $115,870 (Taxable Income)

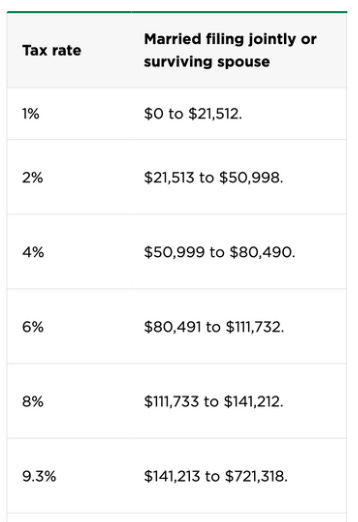

Applying the California tax brackets:

1% on the first $21,512 → $215.12

2% on income from $21,513 to $50,998 → $589.72

4% on income from $50,999 to $80,490 → $1,179.68

6% on income from $80,491 to $111,732 → $1,874.52

8% on income from $111,733 to $115,870 → $331.04

Total California Tax: $4,190

Total Tax Cost in Sabbatical Year: $15,347

Scenario 2: Roth Conversion While Working ($400K Salary Year)

Federal Tax: The entire $126,950 conversion is taxed at 32% due to his $400,000 W-2 income, resulting in $40,624 in federal income tax.

California Tax: The entire $126,950 conversion is taxed at 9.3%, resulting in $11,806 in state tax.

Total Tax Cost in a Working Year: $52,430

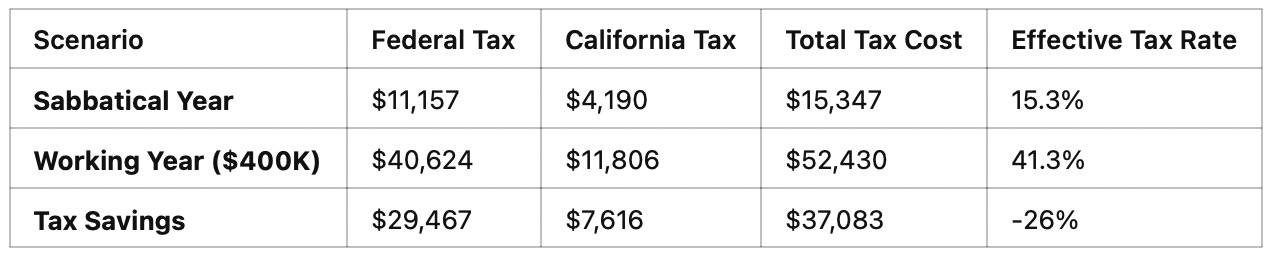

Comparing the Cost of Roth Conversion in a Sabbatical Year vs. a Working Year

By simply waiting until his sabbatical year, James could save $37,083 in taxes on his Roth conversion.

This is because his sabbatical year allows him to take advantage of the lower tax brackets, resulting in a significantly reduced tax bill on the conversion.

Final Thoughts: Roth Conversion During a Sabbatical Year

If you’re planning a sabbatical or an extended break from work, consider converting pre-tax retirement funds to Roth while in a lower tax bracket.

The difference in tax savings could be substantial.

Ensure you have enough cash available to pay the taxes on the conversion. Taxes on Roth conversions are typically due by April 15 of the following year, but estimated payments will likely be required to avoid penalties.

A well-timed Roth conversion can be a powerful tax-saving tool. Always consider your overall financial situation, tax brackets, and long-term retirement strategy before making the conversion.

Disclaimer: click here