Here’s another costly tax mistake I made before becoming a tax professional. This one dates back to 2017, and it all started with a 1099-G form from the State of California, again.

The Mistake

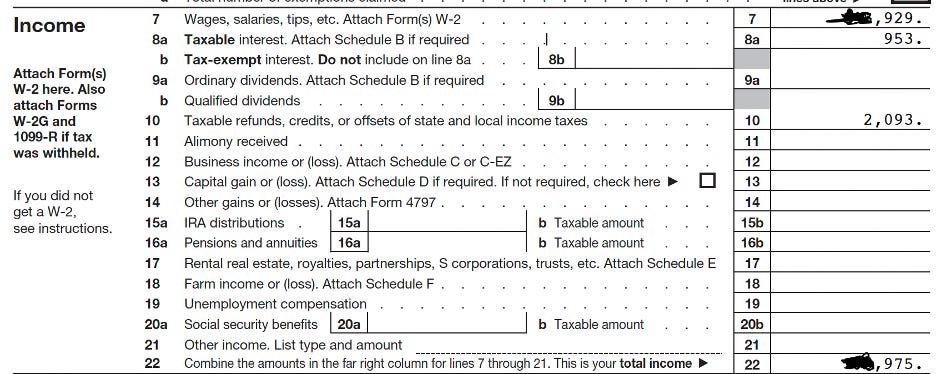

In 2017, I received a 1099-G showing a $2,093 state tax refund from the prior year (2016). Since I had used TurboTax for years to file my taxes, I simply followed the prompts, entered the amount from the 1099-G, and submitted my return - without giving it much thought.

Fast forward a few years - when I went back to review my 2017 tax return, I realized I had made a mistake. That refund shouldn’t have been reported as taxable income at all.

The General Tax Rule About Refunds

If you receive a refund for an expense that previously gave you a tax deduction, that refund is generally considered taxable income.

Example 1: Business Expense Refund

Let’s say your business buys a $2,000 computer and deducts it as a business expense on your tax return in Year 0.

If you return the computer in the following year (Year 1) and receive a $2,000 refund, that refund becomes taxable income on your Year 1 tax return—because you previously claimed a deduction for an amount you ultimately didn’t spend.

Example 2: State Income Tax Refund

The same tax rule applies to state income tax refunds.

If you itemized deductions on your federal tax return and claimed a deduction for state income tax payments in Year 0, then receiving a state income tax refund in Year 1 (due to overpaying state income taxes) could result in taxable income for federal tax purposes in Year 1.

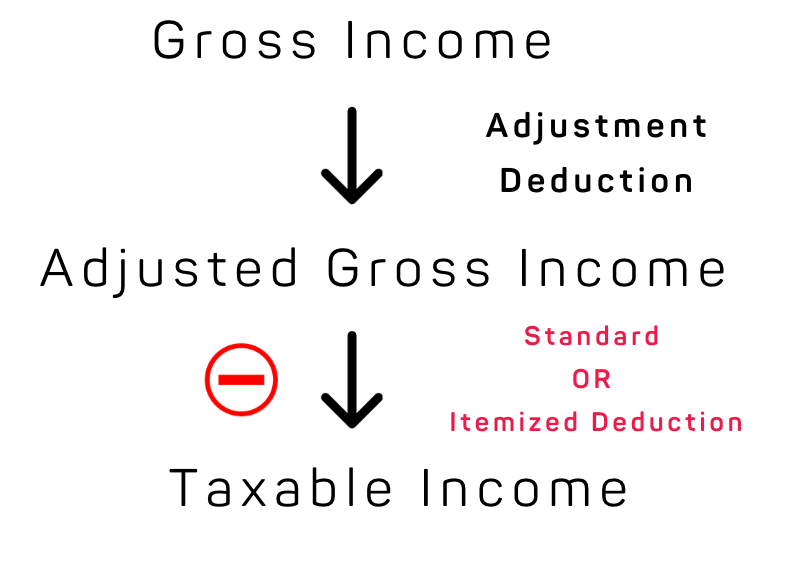

How It Works: Itemized Deductions

Suppose you itemized deductions instead of taking the standard deduction.

Let’s say you paid $20,000 in state income taxes through payroll withholding and claimed $50,000 in total itemized deductions ($20,000 in state income tax + $30,000 in mortgage interest), which lowered your federal taxable income by that amount.

In Year 1, you receive a $2,000 state tax refund because your actual state tax liability was only $18,000.

Since your total itemized deductions should have been $48,000 (not $50,000), that $2,000 refund must be reported as taxable income on your federal tax return in Year 1.

How It Works: Standard Deduction

If you took the standard deduction instead of itemizing, your state tax refund is NOT taxable - because your state income tax payments never provided a federal income tax deduction in the first place.

Why My Refund Shouldn’t Have Been Taxable

In my case, I used the standard deduction in 2016. That means my state income tax payment didn’t reduce my federal taxable income, so the refund shouldn’t have been taxable in 2017.

But - stupid me - I reported the refund as taxable income anyway.

By the time I realized this mistake, it was too late. The three-year statute of limitations for amending my return had already expired, and I couldn’t go back to fix it.

This one simple mistake ended up costing me several hundred dollars in unnecessary taxes.

The Lesson

If you used the standard deduction, your state tax refund isn’t taxable since your state tax payments didn’t provide any federal tax benefit.

However, if you itemized deductions, that refund may be taxable—but the calculation can get tricky. This is one of those areas where consulting a tax professional could save you money and help you avoid unnecessary tax bills.

Disclaimers: click here