A Surprise Tax Refund During Your Residency-to-Attending Transition Year

Courtesy of your residency program… kind of. (But not really!)

Dr. Bone is a new attending who started working at my hospital as an orthopedic surgeon in July 2024.

He recently asked me,

“Kenny Kim, I think I overpaid my Social Security tax. How will I get it back?”

That’s a surprisingly sharp question coming from a new attending—it meant he already knew about the Social Security wage cap.

I said, “Wow, I’m impressed, Dr. Bone!” (He had biceps to match, too).

In this article, I’ll walk you through exactly what I shared with him.

The short answer?

“No worries, man. The overpaid Social Security tax will show up on your tax return as a nice little “bonus"“.”

A Quick Primer on Social Security Tax and the Wage Base

Social security is a payroll tax, with half paid by the employer and the other half withheld from the employee’s paycheck. Each side pays 6.2% on your wages.

Luckily, Social Security tax isn’t applied to all of your income. There is an annual cap known as the Social Security Wage Base.

For 2024, that cap is $168,600.

This means only the first $168,600 of your wage is taxed for Social Security. Any earnings above that are exempt from this tax.

Dr. Bone’s Situation

Like many new attendings, Dr. Bone had two employers in one calendar year - his residency program and his first attending job.

Here’s how his income broke down:

Residency salary (Jan–June 2024): $50,000

Attending salary (July–Dec 2024): $250,000

Total 2024 W-2 wages: $300,000

Here’s where it gets interesting:

He only owes 6.2% Social Security tax on the first $168,600 of his wages. Anything above that is not taxed for Social Security.

Let’s break down the actual withholding

Residency job:

$50,000 × 6.2% = $3,100 withheld (and sent to the government)

Attending job:

$168,600 × 6.2% = $10,453 withheld (Even though he earned $250,000, only the first $168,600 was taxed)

So combined, his two employers withheld:

$3,100 (residency) + $10,453 (attending) = $13,553

But the maximum he is required to pay in 2024 is still only:

6.2% x $168,600 = $10,453!

So, he overpaid by $3,100.

Why Does This Happens?

This kind of overpayment is very common when you have more than one W-2 job in a single year. That’s because:

Each employer calculates Social Security tax based only on the wages they pay you.

Employers don’t know how much you earned elsewhere.

So each employer withholds as if they are your only job.

What Happens to That Overpayment?

The good news: Dr. Bone gets the refund, not his employers.

The $3,100 overpayment will show up as a refundable credit on his tax return.

Here’s how it flows:

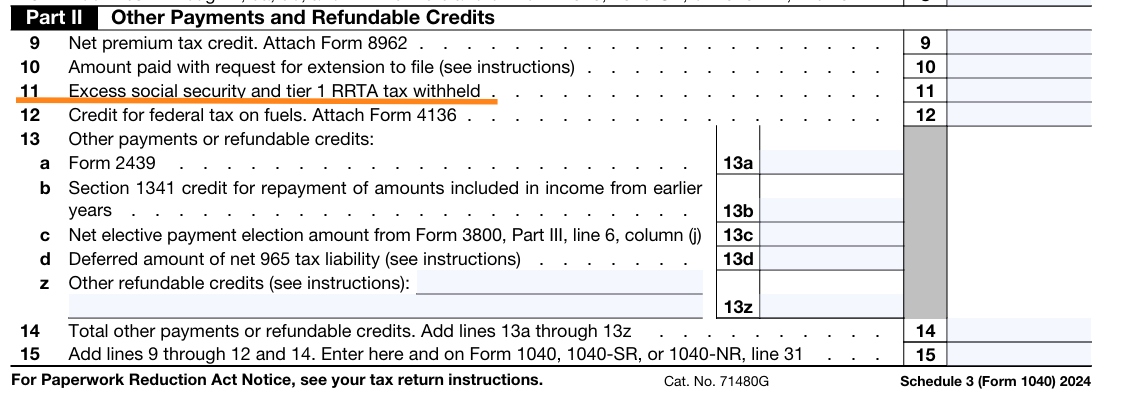

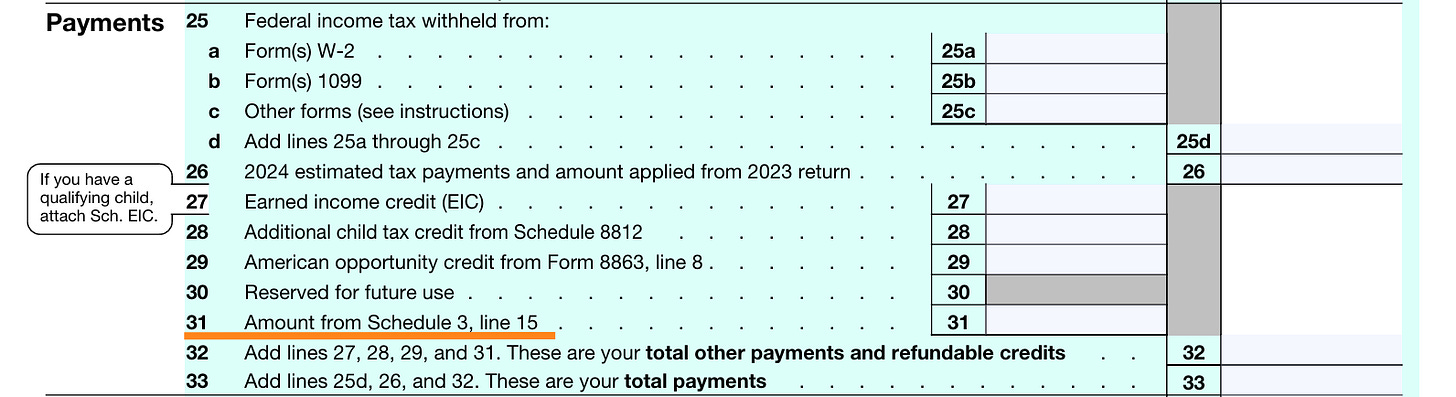

Schedule 3 (Form 1040), Part II, Line 11: “Excess Social Security and Tier 1 RRTA Tax Withheld”

Which then flows to Form 1040, Line 31: under “Total Other Payments and Refundable Credits.”

So yes, that $3100 overpayment becomes a surprise refund.

You could think of it as a “parting gift” from your residency program… who unknowingly withheld a little extra for you. 😂

Thanks, residency, not!

How to Get It? Just Enter Your W-2s

Dr. Bone doesn’t need to bug his employers or file anything extra to claim the refund.

All he has to do is enter both W-2s accurately into his tax software.

The system will automatically detect the overpayment and apply the credit to his tax return- potentially increasing his refund.

Easy win!

Final Thoughts

Overpaying Social Security tax due to multiple W-2s is a common scenario for new attendings. Fortunately, the fix is automatic - as long as you enter your W-2 correctly.

So, what should you do with that little “bonus”?

Maybe:

Toss it into the stock market

Pad your emergency fund

Treat yourself to something meaningful after years of training

(Might be worth chatting with Bryan Jepson MD, CFP if you are thinking investment strategy).

Good luck, Dr. Bone—and to all the other fresh attendings out there.

Disclaimer: click here